Can Hong Kong's free-falling real estate market avoid the cliff, as deep-pocketed Chinese tourists and companies stay away?

By Sandy Li and Lam Ka-sing sandy.li@scmp.com,

kasing.lam@scmp.com

/ https://www.scmp.com/business/article/3076454/can-hong-kongs-free-falling-real-estate-market-avoid-cliff-deep-pocketed?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp&utm_content=3076454 |

Eric Pau, senior associate director at one of Hong Kong's biggest real-estate agencies, vividly remembers the last time a global pandemic brought the city's property market to its knees.

A 23-year-old property salesman at the Amoy Gardens housing estate in Kowloon Bay in 2003, Pau said he could feel the panic spreading through the neighbourhood when 321 of the 19,000 residents in the estate's 19 apartment blocks caught the severe acute respiratory syndrome (Sars).

"Nobody would go and view flats. People tended to rent instead of buy at that time," said Pau, who is with Ricacorp Properties. "Those living at Amoy wanted to move out or buy somewhere else. People were scared. There were not many clients at that time."

Advertisement

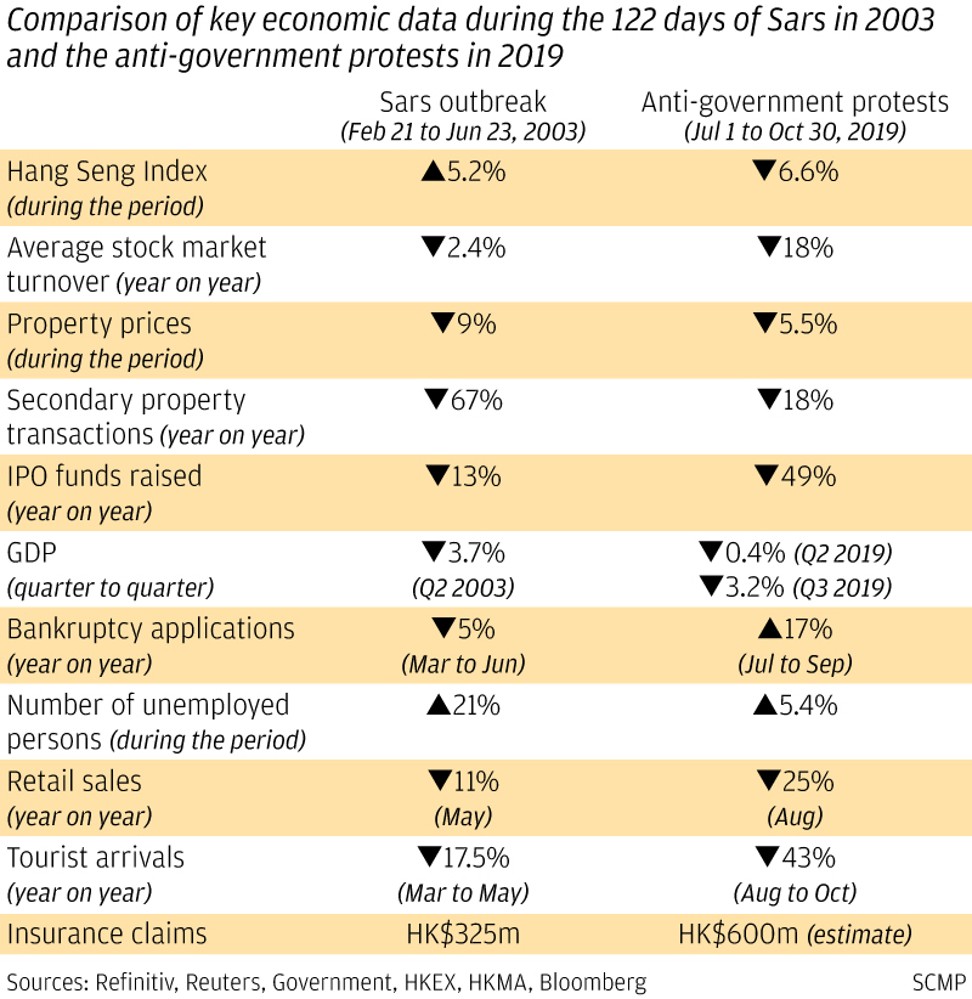

The Sars outbreak, which sickened 1,755 people and claimed 299 lives over 122 days in the spring of 2003, drove Hong Kong's median home prices down by 11 per cent by June. A flat measuring 390 square feet (36.2 square metres) at Amoy Gardens sold for HK$500,000 (US$64,000), a 38 per cent discount to prevailing prices in 2003, piling weight on a market that was already in free fall from its October 1997 peak. The accumulated decline amounted to an unprecedented 68 per cent.

Sources: Refinitiv, Reuters, Government, HKEX, HKMA, Bloomberg. SCMP Graphics alt=Sources: Refinitiv, Reuters, Government, HKEX, HKMA, Bloomberg. SCMP Graphics

The experience of Sars is seared on Hongkongers' collective memory, making surgical masks and regular disinfection of public amenities a part of the city's daily routine. Now, the housing market, where monthly payments towards either rents or mortgages make up between 25 per cent and 60 per cent of gross income, is again under the gun, as the second coronavirus pandemic to ravage the world burns its course through the city.

Hong Kong's economy quickly rebounded from Sars, boosting the city's property and financial markets to ever new heights over the following decade. By 2019, the city could claim the dubious honour of having the world's most expensive offices, homes and shops, as well as the crown of global initial public offering hub seven times in 11 years. The same Amoy Gardens flat that sold in a panic in 2003 is now worth HK$5.7 million, almost 12 times more.

Still, the city might not be as lucky a second time. Hong Kong is unlikely to repeat its V-shaped economic recovery once the Covid-19 pandemic is over, as a critical lifeline is missing this time around " the mainland Chinese tourists, companies and investors with deep pockets that came to the city's rescue in 2003.

Keen to give Hong Kong's economy a leg-up and assuage public disaffection over its handling of Sars and an unpopular piece of legislation, the Chinese government opened the flood gates for mainland tourists, companies and emigrants to enter Hong Kong.

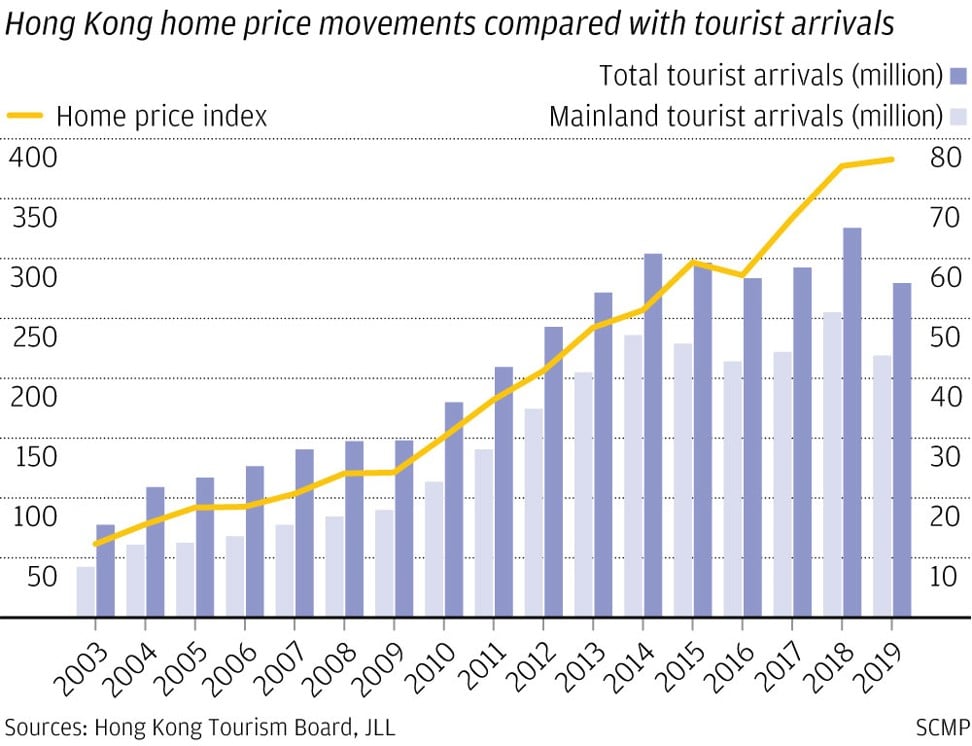

The annual visits by Chinese tourists to Hong Kong soared fivefold to 43.77 million by 2019, boosted by the Individual Visit Scheme of July 2003 which enabled mainland passport holders to visit the city, detached from tour groups or business visas.

Advertisement

This influx was a boon for Hong Kong's retailers and shopping centres, and the city quickly became a hub for luxury shopping, pushing the average retail rent by 116 per cent over the next 17 years to HK$107 per sq ft, or US$8,983 per square metre. By early 2019, Russell Street in Causeway Bay was the world's most expensive high street, surpassing New York's Fifth Avenue, Tokyo's Omotesando and Paris's Avenue des Champs-Elysees.

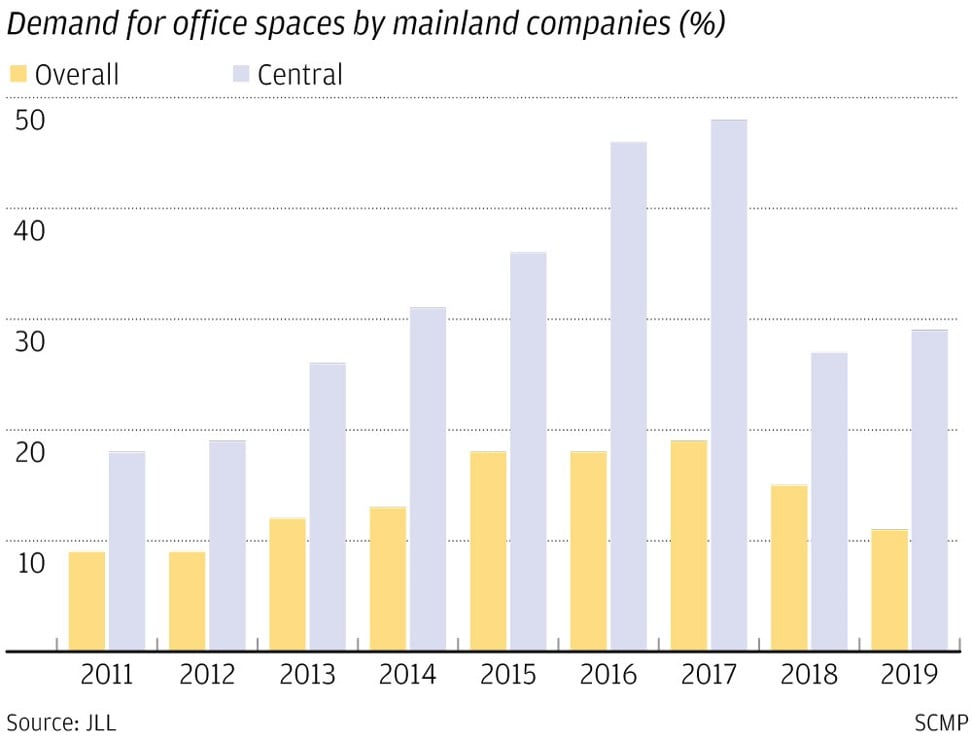

SCMP Graphics alt=SCMP Graphics

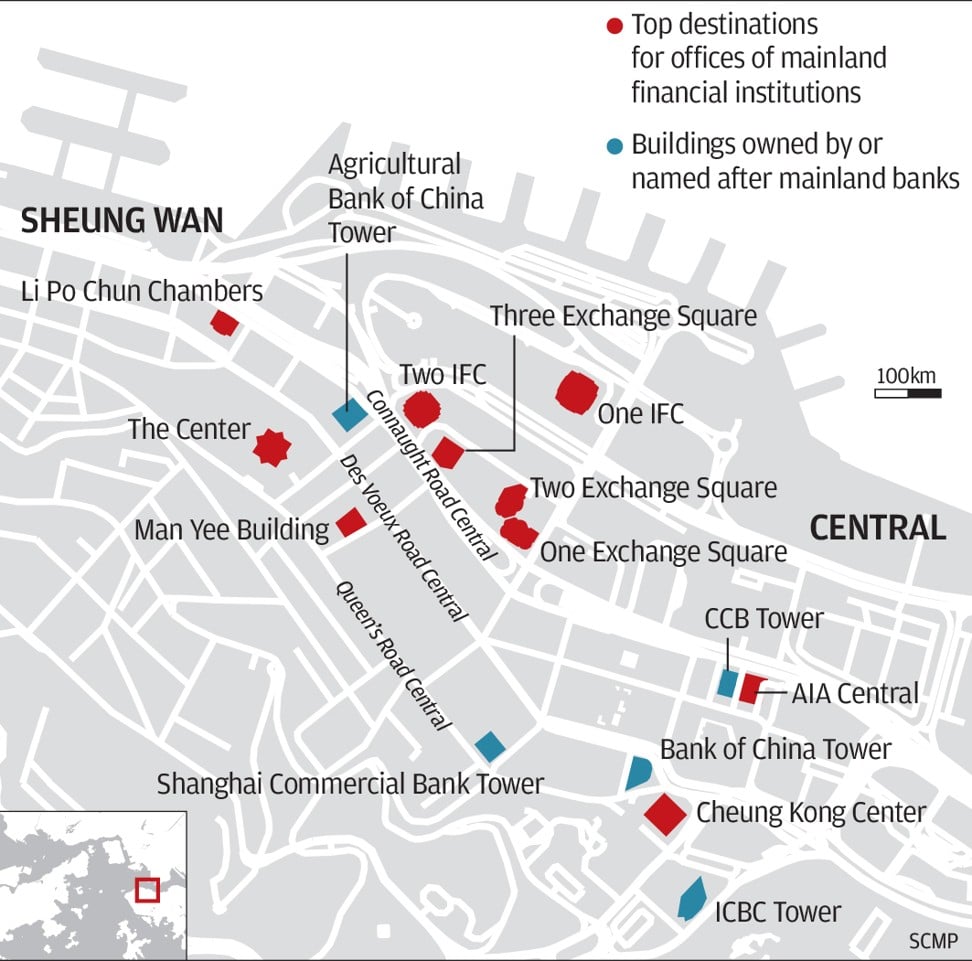

The same was true for commercial property. Thousands of Chinese companies " including all of the country's biggest state-owned banks, brokers and fund management companies " rushed to open offices in Hong Kong as they sought listings in Asia's third-largest capital market. With a penchant for marquee addresses in Central and Admiralty, Chinese companies pushed the median rent of grade A offices to HK$128 per sq ft in a matter of 17 years, again at the highest in the world.

The residential property market also gained. In July 2003, the Hong Kong government introduced a programme for mainland Chinese professionals to take up residence in the city to help ease its talent shortage and enhance its competitiveness.

By 2019, more than a million people from mainland China had settled in Hong Kong. The median price for luxury homes " those priced at more than HK$10 million " had risen by more than fivefold, as local supply could not keep up with the additional demand.

SCMP Graphics alt=SCMP Graphics

In the present day, however, the Covid-19 pandemic is keeping everyone from travelling.

"Many mainlanders are reluctant to come back to pick up the slack and some expatriates were leaving [Hong Kong] even before the Covid-19 outbreak," said Cathie Chung, senior director of research at JLL in Hong Kong. The pandemic has triggered a slow down in the economy and led to lay-offs, disrupting business in the city. "All these factors are a negative for Hong Kong's property market," Chung added.

Just before the first cases of Covid-19 were reported in Wuhan, the capital of China's central Hubei province in December, mainland Chinese visitors had already been deterred by six months of anti-government protests in Hong Kong that had taken on a nativist tone aimed at Mandarin-speakers.

Advertisement

Chinese tourist arrivals plunged 54.2 per cent year-on-year to 2.54 million in January, according to data from the Hong Kong Tourism Board. Moreover, the board said total visitor arrivals would tumble by 96 per cent to 199,000 in February from last year, as more airlines suspended flights to Hong Kong.

Daily travellers globally dropped to 3,300 in February, from 100,000 in January. And these numbers will continue to fall this month, after the Hong Kong government first said all visitors from overseas will be put in mandatory quarantine for 14 days starting March 19, and then banned all foreign tourist and transit arrivals from Wednesday, March 25, for two weeks.

SCMP Graphics alt=SCMP Graphics

A proxy for activity by mainland Chinese home investors is the Buyers' Stamp Duty, introduced by Hong Kong's previous Chief Executive Leung Chun-ying. The 15 per cent tariff for non-resident buyers is aimed at the deep-pocketed buyers snapping up to 40 per cent of new flats.

"Luxury homes will be more vulnerable as the sector largely relies on buyers from the mainland, where the economy has definitely been hurt by the Covid-19 pandemic," said Joseph Tsang, chairman of JLL in Hong Kong, adding that luxury home prices may drop by at least 20 per cent this year.

The number of transactions subject to this duty declined for four straight months to just 62 in February, plunging 88 per cent from a high of 534 in December, 2017. Such deals accounted for just 1.5 per cent of total residential sales of 3,902 homes last month, down from 9.7 per cent of 5,741 deals in December 2017.

The absence of mainland Chinese buyers is hurting the property industry. "The hardest hit will no doubt be retail properties, as the double blows [of the protests and the Covid-19 outbreak] severely diminished tourist and local spending alike," said Chris Yip, senior director at S & P Global Ratings. "This segment will also take the longest to recover, due to the weakening local economy and a decline in visitor arrivals that isn't likely to experience a rapid rebound."

SCMP Graphics alt=SCMP Graphics

"Office demand is subdued as a number of tenants have withdrawn their expansion plans, while demand from mainland firms in Central and co-working operators has also decreased this year by 34 per cent and 26 per cent, respectively," said Alex Barnes, head of markets at JLL.

Rising unemployment also poses a threat to the Hong Kong property market. More than 134,000 people have lost their jobs, pushing the city's unemployment rate to a nine-year high of 3.7 per cent in February. This has forced more people to sell their homes at losses. A 1,588 sq ft home changed hands for HK$21.3 million in late January when the coronavirus broke out in Hong Kong at a loss of HK$10 million, agents said.

Companies that depend on tourism " such as cosmetics retailer Sa Sa, local carrier Hong Kong Airlines and Regal Hotels " are particularly hard hit, and have announced job cuts or unpaid leave for staff since then.

To be sure, home prices had already declined by 5.7 per cent between January and a peak in June 2019, amid the city's protests, according to the Rating and Valuation Department. Office rents in Hong Kong's Central district dropped 6.3 per cent last year. Between a peak in October 2018 and January office prices had declined by 20 per cent. Rents of high-street shops dropped 18.4 per cent last year.

JLL said it expected that both grade A office rents and high-street shop rents will drop further, by as much as 20 per cent in 2020.

Hong Kong Financial Secretary Paul Chan Mo-po announced a HK$120 billion relief package in February to ease the burden on individuals and companies. Part of the package entailed giving a cash handout of HK$10,000 to each of the city's permanent residents aged 18 and above.

But no new policies on boosting mainland Chinese tourism, or increasing residential and commercial land were announced.

Market players had asked the government to roll back its so-called spicy measures, or curbs introduced to cool runaway Hong Kong property prices, to boost sales and increase supply in the secondary residential market and ease a housing shortage. But this was ruled out immediately, according to a senior government official, who spoke on the condition of anonymity and added that interest rates and unemployment were currently lower than in 2003.

Existing owners will be the biggest winners if the spicy measures are removed, the official said. It will not help first-time buyers, and the government would rather focus on helping non-owners to get on the property ladder, he said.

Some property analysts were more sanguine, believing that the Covid-19 pandemic will not lead to the kind of property slump seen in 2003.

"In 2003, we saw panic selling as there were plenty of highly geared investors. The rush for deleveraging drove residential prices down by 68 per cent during the period [1997 to 2003]. The year 2003 was the tail-end of a six-year correction cycle," said Cusson Leung, managing director and head of Asia property and Hong Kong research at JPMorgan Chase, who expects prices to fall 10 per cent this year. "The residential market is currently not in fire-sale mode. Most units have been offered at discounts of just 8 per cent to 10 per cent."

The average loan-to-value ratio in Hong Kong stands at 53 per cent, compared with 66.1 per cent in 2003, and 68.9 per cent in 2002, according to Hong Kong Monetary Authority's data. To underscore Leung's optimism, home price ended 2003 with a 3.5 per cent gain, recovering from an 11 per cent decline in the first half.

About seven out of every 10 borrowers owed less than 60 per cent of the value of their flats in 2019, which means only in the case of a 40 per cent price drop would they be stuck with negative equity, said mReferral Mortgage Brokerage Service. The number of negative equity owners peaked at 106,000 in June 2003. As of December, this number stood at 128 owners, with HK$764 million in home loans.

"Although we do see some weakness in home prices in 2020, the underlying demand and pronounced undersupply remain strong counterweights to any slides in prices," S&P Global Ratings' Yip said.

Hong Kong's annual flat supply has halved to 20,000 a year over the past decade. And with central banks from the United States to the United Kingdom and Canada cutting rates and launching quantitative easing (QE), the cost of money is plunging, and financial liquidity is expected to flow anew.

"[QE] might keep Hong Kong home prices from a free fall," said Alvin Cheung, associate director at Prudential Brokerage. "Under an easing monetary policy, excess liquidity will shift to stocks and the property market, particular in a historical, low-interest environment."

Eric Pau too thinks the current market will rebound after the Covid-19 pandemic fades.

"The market remained quiet for several months amid the [protests]," he said. "[After] the pandemic, the purchasing power that has accumulated for months [will be released], and the market will skyrocket."

Additional reporting by Pearl Liu and Enoch Yiu

Purchase the China AI Report 2020 brought to you by SCMP Research and enjoy a 20% discount (original price US$400). This 60-page all new intelligence report gives you first-hand insights and analysis into the latest industry developments and intelligence about China AI. Get exclusive access to our webinars for continuous learning, and interact with China AI executives in live Q&A. Offer valid until 31 March 2020.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2020 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2020. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/can-hong-kongs-free-falling-real-estate-market-avoid-cliff-deep-pocketed-chinese-tourists-and

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles