China unveils financial plan for Hong Kong, Macau to spur tighter embrace of Greater Bay Area master plan

By Enoch Yiu enoch.yiu@scmp.com

/ https://www.scmp.com/business/banking-finance/article/3084576/china-unveils-financial-plan-hong-kong-macau-spur-tighter?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp&utm_content=3084576 |

China's central bank and financial regulators unveiled a sweeping plan to spur cross-border financial services, transactions and investments between Hong Kong, Macau and nine Guangdong provincial cities to develop the so-called Greater Bay Area (GBA) into one of the world's largest economic regions.

Under the plan, residents of Hong Kong and Macau can buy wealth management products sold by Chinese banks in the region, while the inhabitants of the Guangdong cities can tap financial products sold by the banks in Hong Kong and Macau, according to the announcement by the People's Bank of China, and the securities, bank and currency regulators.

Dubbed the Wealth Management Connect, the scheme is the fourth cross-border investment channel between Hong Kong and mainland China since 2014 " in addition to stocks and bonds " that ties the two financial markets together. It's also a milestone in Hong Kong's evolution as a financial gateway into China.

Advertisement

"The scheme will provide an opportunity for wealthy Hongkongers to diversify their portfolio with investments in the growth potential of the GBA, while providing more investment options for mainland China's population," said the Shenzhen Qianhai Authority's Principal Liaison Officer Witman Hung Wai-man, during the China Conference in Hong Kong by South China Morning Post. "This is a game changer that will tie the Bay Area cities closer with Hong Kong and Macau."

The Greater Bay Area, with a total population of 70 million people across 11 cities and a projected economy estimated at US$1.5 trillion, is the world's 13th-largest economy " ahead of Spain and behind South Korea " if it were a stand-alone economic entity.

The Chinese government is looking to nurture its development into a hi-tech megapolis, combining the technology, financial services and manufacturing prowess of southern China, to rival the Silicon Valley. After the unveiling of the plan, a plot of residential land at the Qiahai district in Shenzhen sold for a record 11.6 billion yuan (US$1.63 billion), as developers piled in to build homes for the expected influx of financial professionals into the GBA.

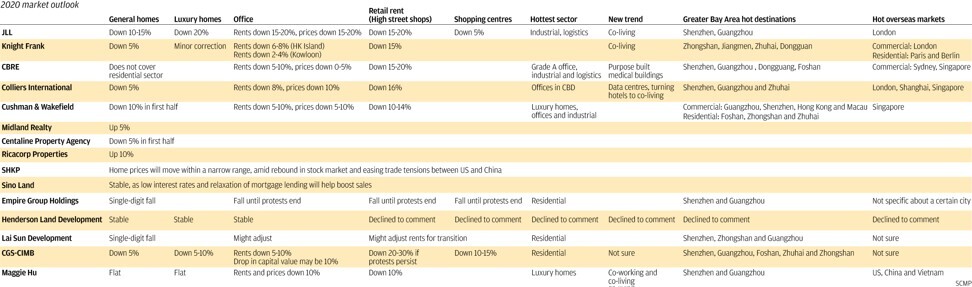

SCMP Graphics alt=SCMP Graphics

In all, 2,135 funds authorised by Hong Kong's Securities and Futures Commission (SFC) stand to benefit if they are made available for sale throughout the GBA, with US$1.78 trillion of assets under investments spanning stocks, bonds and other financial products.

"The guidelines shed more light on the way forward, and the fund management industry warmly welcomes this," said Sally Wong, chief executive of the Hong Kong Investment Funds Association (HKIFA), the industry guild for international funds. "These SFC authorised funds offer a wide array of investment options, are well-regulated and have a very robust investor protection mechanism."

Hong Kong's insurance companies, which may be allowed to set up service centres in the GBA, are also eyeing the Wealth Management Connect to sell funds across the border.

Advertisement

"It will help provide better services to the mainland Chinese customers, and help overcome the inconveniences posed by the entry restrictions [into Hong Kong] during the Covid-19 pandemic," said Eric Hui Kam-kwai, chairman of the Hong Kong Federation of Insurers (HKFI).

Mainland Chinese customers bought HK$72.68 billion (US$9.4 billion) in insurance policies in Hong Kong in 2016 during the height of the cross-border influx, or 39 per cent of all premium collected in the city. This declined to HK$43.4 billion last year as Chinese regulators tightened their currency outflow rules to staunch capital flight, while anti-government protests in Hong Kong deterred Chinese visitors.

Other parts of the plan include support for the offshore yuan business in Hong Kong and Macau, and strengthening of Hong Kong's role as a global hub for the transaction of offshore yuan. A futures exchange will be set up in Guangzhou, while the fundraising of yuan-denominated funds to support the Belt and Road Initiative (BRI) will be encouraged, including support for cross-border bank loans.

"The initiatives will further facilitate cross-border trade and investment, deepen Renminbi (RMB) internationalisation, promote financial connectivity and green finance in the GBA," HSBC's Asia-Pacific chief executive Peter Wong Tung-shun said in a written statement. "The GBA has the scale to rival well-known city clusters such as the New York Metropolitan Area, the San Francisco Bay Area, and the Tokyo Bay Area."

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2020 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2020. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/china-unveils-financial-plan-hong-kong-macau-spur-tighter-embrace-greater-bay-area-master-plan

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles