Demand for Greater Bay Area homes set to rise with easier ownership rules for Hong Kong professional workers

By Sandy Li sandy.li@scmp.com

/ https://www.scmp.com/business/article/3037411/demand-greater-bay-area-homes-set-rise-easier-ownership-rules-hong-kong?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp |

A proposal to ease home ownership and employment rules for Hong Kong residents in the Greater Bay Area may spur demand for properties in the region as more professional workers relocate from the overcrowded financial centre, according to consultants.

The government last week unveiled the proposal by Beijing to boost the integration between the city and nine bordering mainland cities in the Guangdong province. Among the 16 initiatives, China also allowed professionals from the insurance, construction and legal sectors to work in the area, a move that is likely to create an additional source of demand apart from retirees and holidaymakers, they said.

"It will encourage more professionals to relocate there once more job opportunities are created" in those three sectors, said Alva To, vice-president and head of consulting in Greater China at Cushman & Wakefield. "It will be a catalyst to property demand."

Advertisement

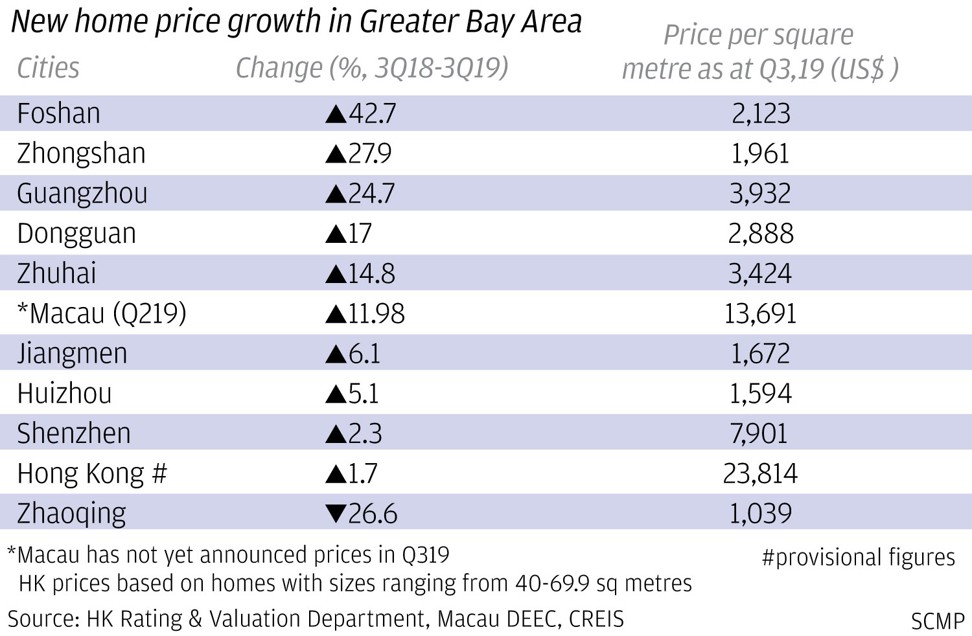

The Greater Bay Area represents China's push to link Hong Kong and Macau with nine Chinese cities in the Pearl River Delta, namely Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing, and turn them into a regional financial and business hub.

Some of the Chinese cities have placed ownership restrictions on Hong Kong residents, including requiring a certain period of residency and tax-paying status. Five of those cities have gradually eased the hurdles since last year, consultants said.

SCMP Graphics alt=SCMP Graphics

Because of the previous hurdles, Hong Kong residents have only accounted for less than 2 per cent of the estimated total residential transaction worth 700 billion yuan in the GBA region, according to CGS-CIMB Securities.

Last year, they bought about 10,000 homes worth 10 billion yuan in those cities, according to Centaline Group.

Among them are Annabelle Cheung and her husband, who are both insurance agents from Tsuen Wan. They spend their weekends at their second home in Zhongshan, a 140-square metre flat which they bought for 970,000 yuan in 2007 and is worth about 2.8 million yuan on the market today.

"My lifestyle in Zhongshan is not a big difference from what we have in Hong Kong, except that I have more spacious home here," Cheung said. "I will think of moving to Zhongshan once insurance agents are allowed to sign up mainland clients in the GBA region."

Advertisement

The Heung Yuen Wai Highway that connects to Lung Shan Tunnel near Fanling with the Shenzhen skyline in the background. Photo: Xiaomei Chen alt=The Heung Yuen Wai Highway that connects to Lung Shan Tunnel near Fanling with the Shenzhen skyline in the background. Photo: Xiaomei Chen

The pair is considering buying another property in Shenzhen " the most expensive among GBA cities " to set up a home office, once restrictions are fully removed, she said. The daily commute between Zhongshan and Shenzhen could be reduced to 30 minutes when a bridge linking both is opened in 2023, she added.

Home prices in Zhongshan have risen by 24.7 per cent in the 12 months through September, making it the second fastest gain among the GBA cities in the mainland, according to data from Cushman & Wakefield. Foshan topped the chart with a 42 per cent advance.

The impact from the policy relaxation may not be significant in the immediate term, according to Raymond Cheng, head of Hong Kong and China research at CGS-CIMB. That is because some of the GBA cities have already removed the restrictions over time.

There has been a 20 per cent increase in Hong Kong people viewing flats Shenzhen even before the official announcement last week, as most cities have eased restrictions for Hongkongers, said Lai Kwok-keung, a director at Centaline (China). "The news may not boost further home sales in GBA in the short term," he added.

Whether the latest measures can boost the region's attractiveness to professional talents from Hong Kong will depend on job opportunities and disposable income levels, said Marcos Chan, head of research of the Greater Bay Area and Hong Kong at CBRE.

"Job matching is key," Chan said. "It would take a significant change in overall corporate strategies by allocating more, say management level, roles to the GBA cities, coupled with comparative advantages of individual cities to see an apparent change in where talents are based."

Advertisement

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2019 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2019. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/demand-greater-bay-area-homes-set-rise-easier-ownership-rules-hong-kong-professional-workers

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles