Hong Kong's higher mortgage cap deters at least one developer from building micro-flats as buyers can now afford larger homes

By Lam Ka-sing kasing.lam@scmp.com

/ https://www.scmp.com/business/article/3038252/hong-kongs-higher-mortgage-cap-deters-least-one-developer-building-micro?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp |

The boom in Hong Kong's micro-apartments appears to be over, as the first easing in mortgage entitlements in a decade has helped buyers to afford larger homes, causing at least one developer of shoebox-sized property to quit the market.

Micro-apartments, defined as those smaller than 200 square feet (18.6 square metres), are unsustainable as investments, and are the most prone to any declines in property prices, said Rykadan Capital, the developer that recorded HK$390 million of sales from 66 units of The Paseo, from a site no bigger than a basketball court in the Jordan neighbourhood in Kowloon.

"We did pretty well at that time [of the project's launch in 2015], but we [are not building any more] since then because we thought it might not be sustainable," said Rykadan's chairman and chief executive William Chan, adding that the developer has turned instead to building offices. "There was growth in the micro [flats market], but in the [current] market condition, they will be the first to feel the impact."

Advertisement

Hong Kong's residential property market, the world's most expensive on a per square foot basis for nine consecutive years, has lost its footing this year, weighed down by a combination of the year-long US-China trade war, unprecedented political unrest in the city and an impending flood of new homes as developers are forced by the local government's vacancy tax to stop hoarding completed flats. A new entitlement to more mortgage financing has encouraged homebuyers to look into bigger homes.

William Chan, chairman and chief executive officer of Rykadan Capital in Kwun Tong, on 12 November 2019. Photo: Tory Ho alt=William Chan, chairman and chief executive officer of Rykadan Capital in Kwun Tong, on 12 November 2019. Photo: Tory Ho

"This opens up more choices for first-time buyers and increases their purchasing power," said Henry Mok, senior director of capital markets at JLL the property consultant. "Developers are likely to shift away from incorporating [micro-apartments] in their new developments. We will start to see new supply [of these flats] decrease from 2022."

The decline is already noticeable in Hong Kong's property market. At the T-Plus building in Tuen Mun, the smallest flat measures 128 sq ft, smaller than the footprint of a standard Hong Kong parking space. The developers Jiayuan International and Stan Group sold only two of these micro-apartments last November, before slashing prices by as much as 38 per cent in July.

The same dismal result was reported at the Parkes Residence flats in Jordan, where a 245-sq ft unit changed hands last month for a loss of HK$1.24 million, or 30 per cent from the purchase price, over five years. The transacted price was a three-year low for the building.

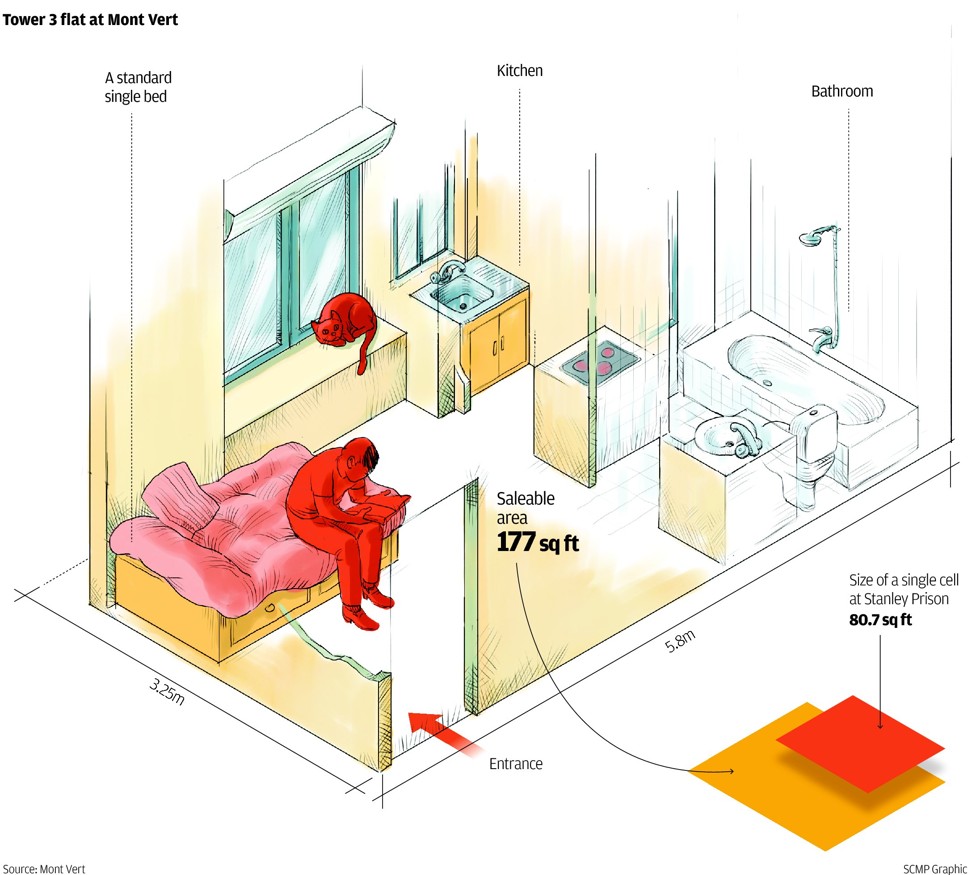

A representation of a micro-apartment at Mont Vert in Fanling, developed by CK Asset Holdings, which kicked off the trend of building tiny abodes smaller than 200 square feet in size. SCMP Graphics. Source: Mont Vert alt=A representation of a micro-apartment at Mont Vert in Fanling, developed by CK Asset Holdings, which kicked off the trend of building tiny abodes smaller than 200 square feet in size. SCMP Graphics. Source: Mont Vert

Its Wong Chuk Hang offices are larger at about 100,000 sq ft, with a gross development value of about HK$3 billion. Offices in the neighbourhood are priced at up to HK$30,000 per sq ft.

Hong Kong's office rents could plummet by up to 20 per cent if unemployment rate rises by 2 percentage points, according to a forecast by Midland IC&I, one of the city's biggest property agencies.

Advertisement

An office at the Bank of America Tower in Admiralty measuring 3,857 sq ft was leased at a monthly rate of HK$58 per sq ft in October, almost 33 per cent off the landlord's asking lease, and the lowest in the tower for more than three years. Grade A offices in Sheung Wan, within walking distance from Central, sold for discounts of as much as 8.9 per cent on average in October at a three-year low of HK$25,000 per sq ft, said Eric Ong, chief operating officer and director of commercial department at Midland IC&I.

"After the downbeat performance of the office market, some owners have finally accepted the reality and are offloading their stock by slashing prices by 30 to 40 per cent," he said.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2019 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2019. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/hong-kongs-higher-mortgage-cap-deters-least-one-developer-building-micro-flats-buyers-can-now-afford

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles