Hong Kong's property market has 10 more years in its bull run as population inflow from Greater Bay gives it sustenance

By Sandy Li and Cheryl Arcibal sandy.li@scmp.com,

cheryl.achibal@scmp.com

/ https://www.scmp.com/property/hong-kong-china/article/3009468/hong-kongs-property-market-has-10-more-years-its-bull-run?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp |

Hong Kong's property bull market has another 10 years to run, as housing supply fails to keep up with the new population pouring in from the Greater Bay Area, said the Swiss bank UBS, which correctly picked the bottom in the city's short-lived price correction last year.

Home prices will continue spiralling upwards as buyers compete to get their hands on residential property, according to the bank's real estate research team, led by John Lam. Hong Kong's annual housing stock is estimated at 45,000 homes a year, 25 per cent short of UBS' calculation.

"Our analysis based on demographics and non-local demand suggests annual housing demand would stand at 60,000 units," Lam said. The Greater Bay Area, a cluster of 11 southern Chinese cities including Hong Kong and Macau, "should enhance integration [within] the area through improving software and hardware, lowering transaction costs and boosting economic activity. We believe this will benefit Hong Kong property."

Advertisement

UBS isn't alone with the bullish forecast. Moody's Investors Service said Hong Kong's home prices would rise between 8 per cent and 10 per cent over the next 12 to 18 months, revising its earlier estimates of a drop of up to 15 per cent, with its vice-president Stephanie Lau predicting median home price to surpass its July 2018 record.

The forecasts by UBS and Moody's pose a policy challenge for Hong Kong's Chief Executive Carrie Lam Cheng Yuet-ngor and her administration, which have made affordable housing a key policy objective.

Hong Kong's government may give the city's subway operator and the urban redevelopment authority a greater role to provide affordable housing, such as turning more urban projects into subsidised homes, and reserving sites along rail lines for public housing, Financial Secretary Paul Chan Mo-po said in an interview with South China Morning Post .

UBS's research team correctly picked the property market's inflection point last year, when Hong Kong's median home prices declined by 9 per cent between August and December.

That correction amounted to a blip in the record, as dovish interest rate policies by the US and Hong Kong monetary authorities kept the city's mortgage rates low, encouraging buyers to get on the property ladder while investors sought out better returns in fixed assets. Median home price rose by 5 per cent in the first quarter, according to the Rating and Valuation Department.

The Greater Bay Area, with a combined population of 70 million people and an estimated economic output of US$1.5 trillion, would be the driver of Hong Kong's property growth, even as the local population shrinks.

Advertisement

"Although housing demand from local residents is likely to decline due to an ageing population over the next 10 years, we believe demand from non-locals will be more than enough to outweigh it," Lam said. "Given limited housing supply and the integration with the Greater Bay Area, we forecast the housing shortage to persist and widen, supporting long-term property prices."

At Wheelock Properties' Montara project in Lohas Park, 36 buyers vied for each of the 500 units available. The developer sold every single unit for a total haul of HK$4 billion (US$510 million), setting a record for the biggest one-day turnover.

The fear of missing out on the bull run also spilled over to an obscure segment of the property market called the "sandwich class." A 24-year flat at Tivoli Garden in Tsing Yi, measuring 706 square feet (65 square metres), sold for a record HK$10 million, a price record for property that's classified between subsidised housing and private homes.

SCMP Graphics

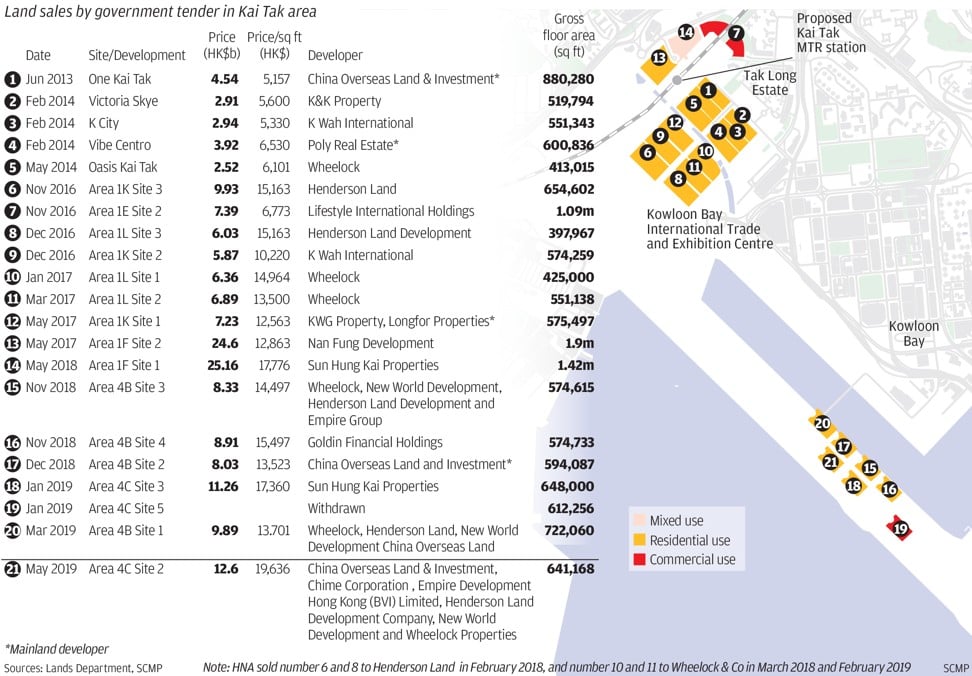

Developers are setting their sights on the future, when prices are double the prevailing level. A residential site on the runway of the former Kai Tak airport sold on Tuesday for a record HK$12.6 billion.

That price translates to a land cost of HK$19,636 per sq ft, which means that a completed home would need to sell at about HK$30,000 per sq ft after factoring in construction cost and a 20 per cent profit margin, which would price a 1,000 sq ft flat at HK$30 million.

While most property analysts and real estate research teams have revised their assessments to a 10 per cent increase in 2019 home prices, UBS has gone the furthest to project continuous increases for another decade.

Advertisement

"If you ask me whether home prices will continue to rise over the next 30 to 50 years, the answer is definitely yes," said Vincorn Consulting and Appraisal's managing director Vincent Cheung, adding that prices will rise by 5 per cent by the end of 2019. "The key is to time [the entry into the property market] particularly when home prices tend to go up and down."

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2019 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2019. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/hong-kongs-property-market-has-10-more-years-its-bull-run-population-inflow-greater-bay-gives-it

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles