In Hong Kong's property market, HK$10 million no longer buys what it did in 1997

By Lam Ka-sing

/ SCMP |

Aerial view of high-rise buildings in Hong Kong's Kowloon District, pictured in July 2020. (Photo: SCMP / Sun Yeung)

SINGAPORE (EDGEPROP) - Hongkongers' spending power in terms of homebuying has shrunk dramatically since 1997. After a significant trough in the years after the handover, home prices have climbed to new peak levels over the last decade while riding a 13-year rise, pricing many buyers out of the market and squeezing people who can afford to buy into 'shoebox' flats.

Comparing 1997 to 2021, Hong Kong's overall price index for lived-in homes - an economic bellwether tracked by the government's Rating and Valuation Department - rose 140%, from 163.1 to 392.7.

Advertisement

The index has hit a series of records over the past few years, peaking at 398.1 in September 2021 before some softness amid the fifth wave of Covid-19 infections this year.

Values for the vast majority of properties have surged since the handover, and some have achieved eye-popping levels of appreciation. As a result the city has in the past decade repeatedly been crowned with dubious titles such as "the most unaffordable" and "the most expensive" housing market.

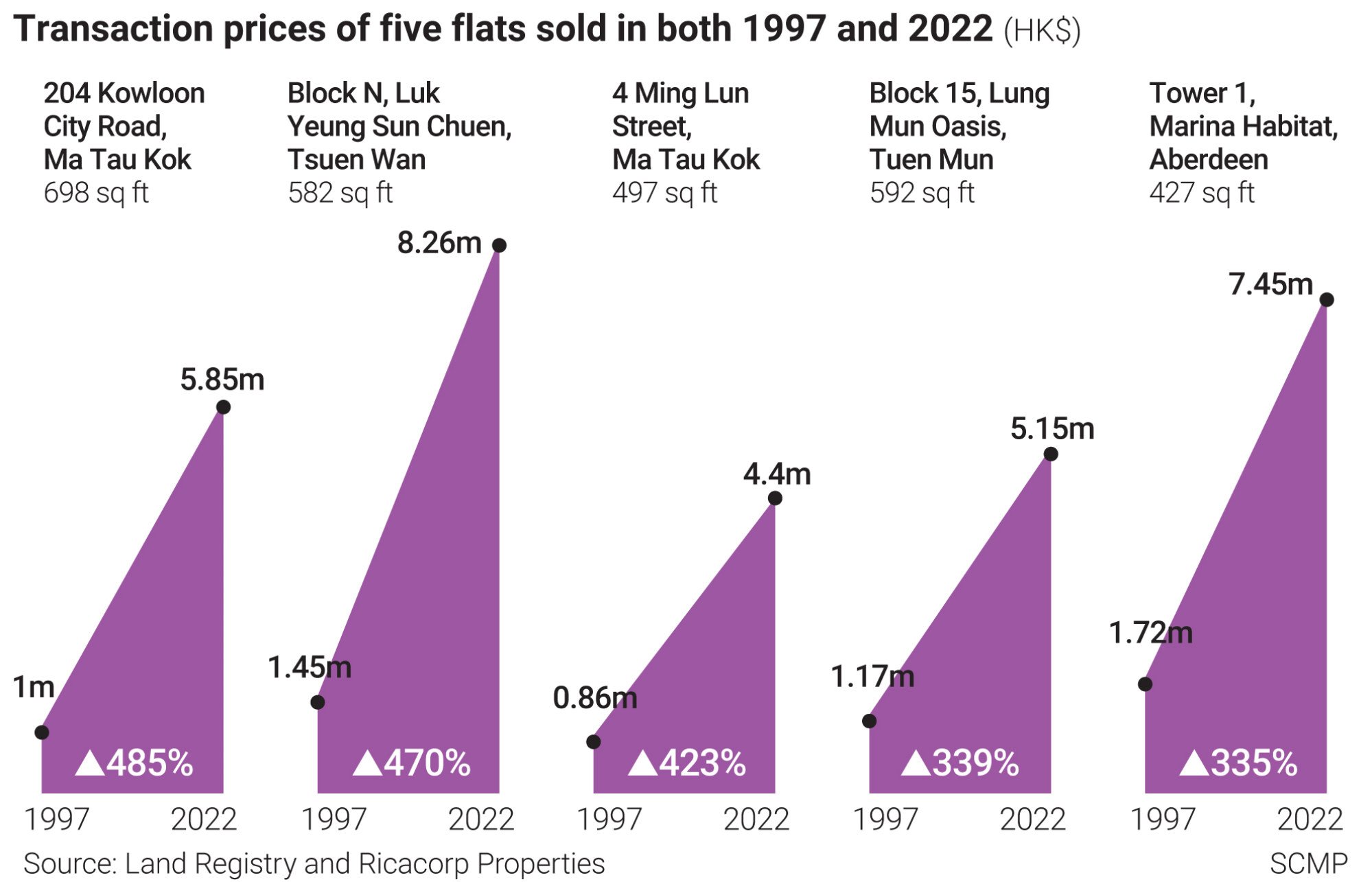

These five specific flats, which sold on the secondhand market in both 1997 and 2022, represent the upper end of price appreciation since the handover.

Comparing 1997 to today does not tell the whole story of Hong Kong's residential property market, however, as the appreciation in home prices has been anything but smooth and steady - especially for individual buyers.

Rickey Chan, managing director of local property agency Dorbo Realty, can attest to that.

Common Bond Building in Tuen Man. Photo: Handout

In March 1997, Chan bought a flat measuring 333 sq ft in the Common Bond Building in Tuen Mun for HK$950,000 ($167,811).

Chan sold the flat at a loss in November 2006, offloading it for HK$480,000, according to official records he provided. At the time, he needed to move to another district and did not believe leasing the flat would yield much return.

However, the flat one floor below his changed hands at HK$4.1 million in March last year, according to records from property platform Property.hk.

Advertisement

Aerial view of high-rise buildings in Hong Kong's Kowloon District, pictured in July 2020. Photo: SCMP / Sun Yeung

"It has risen almost 10 times, compared to when I sold the flat, which was the lowest point," Chan said.

In fact, 1997 was a high-water mark for home prices at the time. The government's index of home prices soon fell 66 percent between 1997 and 2003, before beginning a long and mostly steady rise. From July 2003 to its recent September 2021 peak, the index has risen 582%.

Chan, who started his agency in 1995 and has also worked as a civil servant, regrets the hit he took on his Tuen Muen flat. He expressed empathy for young people today, who may not even get the chance to make such poorly timed choices.

Jiang Zemin shakes hands with Prince Charles at the handover ceremony marking Hong Kong's return to Chinese sovereignty at midnight on July 1, 1997. Photo: SCMP / Robert Ng

"Although 1997 could be considered a peak, home prices at that time were much cheaper than now," he said. "Youngsters now find it more difficult to buy homes now than that time."

With even 300 sq ft entry-level homes in Tuen Mun, one of Hong Kong's least expensive districts, now costing over HK$4 million, "youngsters really need parental help to buy homes, otherwise it will be very difficult to save for the downpayment", he said.

The city in 1997 recorded 2,436 secondary residential property transactions valued between HK$10 million and HK$12 million, according to Ricacorp Properties. The areas with the most sales in that price range included Mid-Levels West, Fo Tan, Kau To Shan, Happy Valley and Tai Hang. Royal Ascot, near the Sha Tin Racecourse, had the highest number of transactions at 251, with Taikoo Shing and Palm Springs in Yuen Long also seeing a lot of sales.

Advertisement

The number "should be high because the transaction volume of the property market was the most feverish in 1997, and then it burst and quickly fell", said Derek Chan, head of research at Ricacorp.

In 2021, the city saw 3,275 secondary residential property transactions between HK$10 million and HK$12 million, according to Centaline Property Agency, 34% more than in 1997.

Reasons for the high property prices in Hong Kong are multifaceted. Since colonial times, the city has chosen a policy of maintaining high land prices and a low tax rate. The city's high population, limited land supply, and developers' pricing strategies also contribute.

As long as the government keeps the high land price policy, Rickey Chan expects prices to remain high. Only if the government follows Beijing's policy that "homes are for living in, and not speculation" and reduces land prices will home prices follow suit.

Chan expects home prices to rise 5% this year despite recent softening, and forecasts that volatility in the coming three years will remain within 10%.

https://www.edgeprop.sg/property-news/hong-kongs-property-market-hk10-million-no-longer-buys-what-it-did-1997

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles