How To Finance A Property In London With A Singapore Bank

By Justin Koh

/ Redbrick.sg |

In recent years, Singaporeans have been one of the biggest buyers of London properties, favouring new-built and luxury flats.

Due to its stable residential development and a naturally competitive market, London continues to be a safe haven for smart property investors. Despite recent challenges and Brexit, investor sentiment towards real estate investment still remains positive.

Since 2012, Singapore banks have been growing their overseas properties portfolio, particularly in London. For investors who want to invest in London properties, they can take up a London property loan with a Singapore bank.

Advertisement

So, why is it advisable to go through a Singapore bank, and what are the things to consider when taking up a home loan?

What are the requirements to take up a loan?

Applicants can choose to take up the financing in either Singapore Dollars (SGD) or British Pound Sterling (GBP).

What are the documents required?

- 1. A copy of the Property Purchase Agreement.

- 2. Loan statement from the existing bank or financial institution for the latest 12 months for refinancing.

- 3. Tenancy agreement if applicable.

- 4. Income documents:

- For salaried employees, latest tax assessment and latest CPF statement

- For self-employed, latest 2 years of income tax assessment.

How you can benefit from financing in SGD?

One of the main advantages for applicants working in Singapore and earning in SGD, financing a London property investment is in the same currency as your income. Essentially, this means:

- 1. Lower interest rates as compared to taking up a loan in the UK

- 2. Faster approval as services received are from a local bank in Singapore

- 3. Transparent loan rates with SGD loans pegged to inter-bank rates, like the 3 month SIBOR (e.g. 3 Month SIBOR + 2.5%)

- 4. Rates offered are throughout the entire loan tenor hence no need to do refinancing

- 5. Enjoy significant savings from one-time admin cost, legal and valuation fees

- 6. Can cash out via London property in the future

Advertisement

What are the banks in Singapore that can finance London properties?

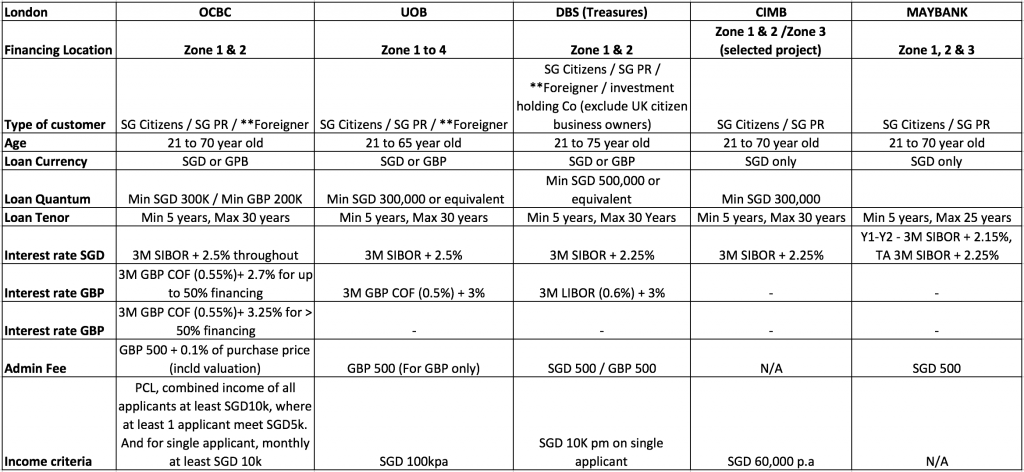

To get a loan to bridge the purchase for a London property, investors have several financiers to choose from:

- 1. UOB

- 2. OCBC

- 3. Maybank

- 4. DBS

- 5. CIMB

What other taxes and charges to take note of?

Every country has its own regulations and laws. Speak to a professional tax advisor or lawyer to find out more details regarding taxes and charges in London.

- 1. Stamp Duty – Stamp duty rates vary from state to state, do take this into account when you purchase your property.

- 2. Stamp Duty Land Tax (SDLT) – Stamp duty land tax is payable upon completion of property.

- 3. Income Tax – Income tax is levied on the rental income. Letting agent’s fees, mortgage loan interest, service charges and ground rent can be used to reduce the taxable income.

- 4. Council Tax – Also known as annual London property tax. It is levied on local property by local councils. Generally, the higher the property price, the greater the tax will be.

- 5. Capital Gains Tax – Part of Income tax. This is the tax payable on capital appreciation.

- 6. Inheritance Tax – Tax on monies or possessions someone left behind after passing.

How can I manage my property? / Who can help me manage my property?

Employ a professional property management firm, particularly if you are based in overseas.

Property management companies usually assist homeowners with the management and maintenance of their London properties. Their services enable you to concentrate on important matters such as family or work, and they will dedicate their time to ensure your property runs smoothly. They attend to emergencies, repair wear and tear to make sure the property is secure and safe to live.

Conclusion

Investing in overseas properties will always carry an inherent risk of foreign exchange. For example, if you have taken a loan in SGD and it weakens against GBP or AUD, there is a chance that you may have to top up this difference yourself in cash.

The weak pound is continuing to attract travelers especially Asian tourists into London. Growth in tourism will keep pushing further developments of retail and residential assets. For anybody who is entering London market with a foreign currency, he gets a lot more stones than he did get before.

Advertisement

This article was first published on Redbrick.sg.

https://www.edgeprop.sg/property-news/how-finance-property-london-singapore-bank

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles