Kai Tak's third-largest oceanfront plot sells for a record HK$12.6 billion as developers snap up land in Hong Kong's property bull run

By Pearl Liu peral.liu@scmp.com

/ https://www.scmp.com/property/hong-kong-china/article/3009237/kai-taks-third-largest-plot-residential-land-goes?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp |

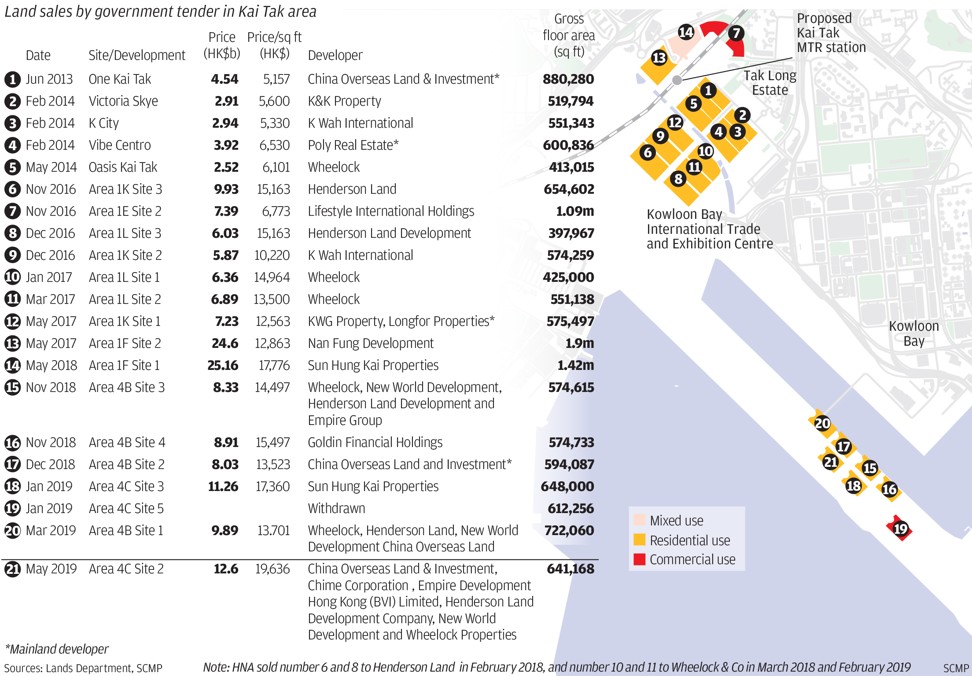

Six Hong Kong developers have agreed to pay HK$12.6 billion (US$1.6 billion) for the third-largest plot of residential land on the runway of the former Kai Tak airport, forking out a record price for the prime oceanfront real estate as a property bull market resumes in the world's costliest city.

The government tender for Kai Tak Area 4C Site 2 was won by the Marble Edge Investment consortium, comprising China Overseas Land & Investment, Chinachem Group, Empire Development, Henderson Land Development, New World Development and Wheelock Properties. An estimated HK$18 billion will be invested into the plot, with 641,168 square feet of gross floor area.

The price translates to a land cost of HK$19,636 per sq ft, which means an apartment complex built on the site will have to sell for at least HK$30,000 per sq ft, inclusive of a construction cost of between HK$5,000 and HK$7,000 per sq ft, with a 20 per cent profit margin for the developer. That would price a 1,000 sq ft (93 square metres) flat at HK$30 million.

Advertisement

The record-setting price shows that the short-lived price correction in Hong Kong's home market between August and December is well and truly in the rear-view mirror. Moody's Investors Service revised its 2019 forecast of Hong Kong's home prices to an increase of between 8 per cent and 10 per cent, reversing course from last November's prediction when the expectation was for prices to drop by 15 per cent over the subsequent 12 to 18 months.

SCMP Graphics

In land-scarce Hong Kong, land bids are often a weather vane for the property market's direction, where Kai Tak " offering full view of Victoria Harbour and earmarked to be the next central business district of the financial powerhouse " is the epicentre of the trend.

The roller-coaster ride in home prices came after the dovish interest rate policy by the US Federal Reserve, which compelled Hong Kong's monetary authority to mirror the same policy stance. As a result, the property bull market returned to the city, posing a stiff policy challenge to the administration of Chief Executive Carrie Lam Cheng Yuet-ngor.

The winning bid for the site, the 21st piece of Kai Tak land sold by government tender since 2013, smashed the May 2018 record set by a mixed-purpose site on the former airfield, which sold for HK$25.1 billion, or HK$17,776 per sq ft to Sun Hung Kai Properties.

In December, when Hong Kong's housing market went through a five-month price correction, China Overseas Land picked up Hong Kong's final residential plot of the year for a bargain price of HK$8.03 billion, or HK$13,523 per sq ft.

What's giving developers confidence is the rate at which homebuyers are flocking to sales rooms and snapping up new, lived in and even semi-subsidised flats known as "sandwich flats."

Advertisement

In a sale of 1,148 flats last Saturday " the biggest weekend launch in six years " as many as 1,001 flats, or 87 of the total on offer, were sold in a day, with Wheelock receiving 36 bids for every single one of the 500 flats it had to sell. The Montara project sold out for a total of HK$4 billion, helping Wheelock set a record for a single day's turnover.

By the middle of this year, developers are expected to put more than 6,000 new homes on the market.

According to Centaline Property Agency's Centa-City Leading Index " which reflects weekly changes in the secondary market " the gauge has risen for 12 straight weeks up to May 3. It jumped 0.4 per cent to 183.92, just shy of the record 188.64 clocked last August.

It will put further pressure on the city administration led by Lam, who felt forced to warn about the spectre of rising home prices in March, as easing a housing shortage in the world's least affordable city for owning a home, was one of her key policy priorities.

The Kai Tak development aims to house up to 90,000 people and create more than 83,000 jobs by making it the city's second most important business district. It aims to provide 62.43 million sq ft of office space, doubling the space in Central by 2020.

Empire Development is the company chaired by Sun Hung Kai Properties' former chairman Walter Kwok Ping-sheung, who died last October.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2019 South China Morning Post Publishers Ltd. All rights reserved.

Advertisement

Copyright (c) 2019. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/kai-taks-third-largest-oceanfront-plot-sells-record-hk126-billion-developers-snap-land-hong-kongs

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles