SINGAPORE BUDGET 2018: Buyer’s Stamp Duty for residential properties over $1 mil rises to 4%

By Angela Teo

/ EdgeProp |

Updated, Feb 22, 2018, 12:04 p.m., to reflect changes as published in EdgeProp Pullout, Issue 819 (Feb 26, 2018). Also previously updated to specify that rate raise applies only to top marginal buyer's stamp duty.

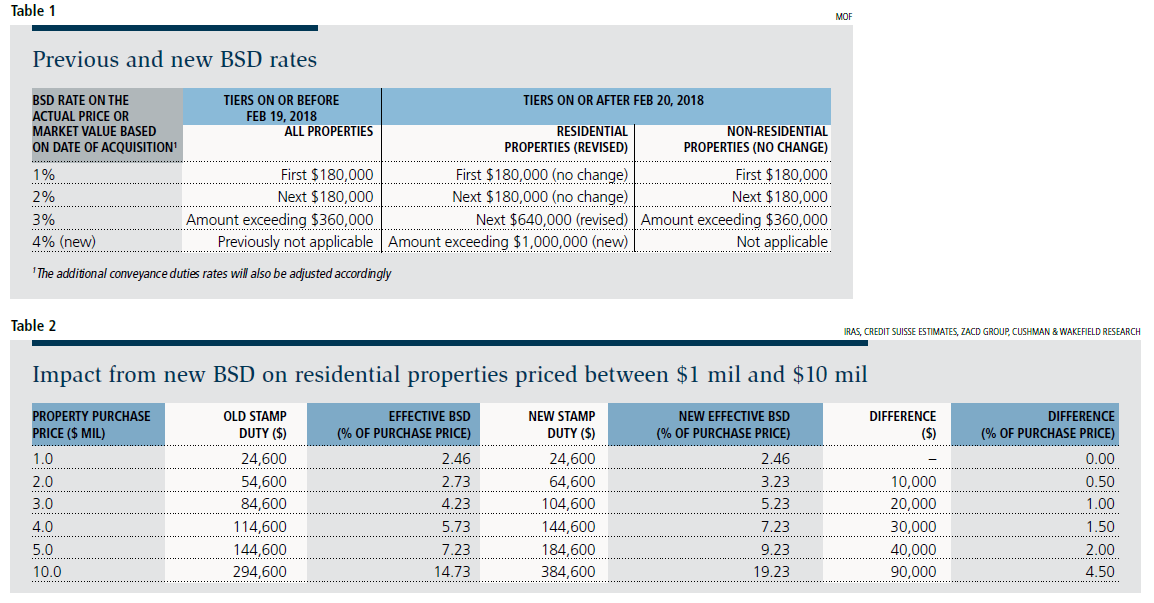

The top marginal buyer’s stamp duty (BSD) for residential properties priced at more than $1 million has been increased to 4% with effect from Feb 20, announced Minister for Finance Heng Swee Keat on Feb 19 during the Budget 2018 speech (see Table 1).

This is revised from the previous BSD rate: 1% for the first $180,000, 2% for the next $180,000 and 3% for the remainder of the purchase price or market value of the residential property, with no further tiers for properties priced or valued above $360,000.

Advertisement

Jefferies’ Guha considers the BSD rate rise to be ‘marginally negative’ for developers, whose margins could be dented should they choose to absorb the additional BSD in individual property transactions (Credit: Samuel Isaac Chua/The Edge Singapore)

Assuming a buyer purchases a residential property with a price tag of $2 million, that means paying $10,000 more BSD, estimates Nicholas Mak, executive director at ZACD Group (see Table 2). The difference, however, remains a fraction of the total transaction amount, he notes.

If a buyer is granted the option to purchase a property on or before Feb 19 and exercises it before March 12 or the date of expiry of the option’s validity period, the buyer may apply to the Inland Revenue Authority of Singapore for remission to follow the BSD rate before this revision, according to IRAS.

This is the first BSD rate increase on residential properties since 1996, so there is no comparable in recent history, according to Krishna Guha, equity analyst at Jefferies. “It is more a revenue measure than a demand cooling measure and the impact will be mild on mid-end property purchases,” he says.

This increase affects direct purchases and purchases made through share transfers in companies primarily holding residential properties, he points out.

Guha considers the BSD rate rise to be “marginally negative” for developers, whose margins could be dented should they choose to absorb the additional BSD in individual property transactions. “However, given the buoyant sentiment and bullish land bids by developers, expectations of future price increases may exceed the impact of the higher stamp duties,” he reckons.

Christine Li, head of research at Cushman & Wakefield, does not expect the BSD rate increase to have a substantial cooling effect on property demand when it comes to small-ticket transactions. She expects the bulk of the additional BSD contribution to come primarily from the sale of Good Class Bungalows, Sentosa Cove bungalows and residential units priced at $5 million and above.

Advertisement

“The move, however, may have a dampening effect on the collective sale market, as the BSD rise can be hefty for most collective sale deals, which easily run into hundreds of millions of dollars,” she says.

For non-residential properties, the BSD rate remains the same: 1% for the first $180,000; 2% for the next $180,000 and 3% for the remainder of the property’s price or market value.

“That is a positive for Singapore real estate investment trusts, as they typically buy commercial and industrial properties in the city state,” notes Andy Wong, investment analyst at OCBC Investment.

Finance Minister Heng also announced that the anticipated hike in the Goods and Services Tax will only occur between 2021 and 2025 — later than expected. GST is expected to be raised from the prevailing 7% to 9%.

Jefferies’ Guha believes the GST increase will have an impact on household savings and the affordability of properties, as property purchases are often long-term commitments. “A household with a 20% savings rate will see savings decline by 7.5% when the GST rate is increased, everything else remaining the same,” notes Guha. “This will reduce housing affordability in the medium term. Buyers, however, tend to underprice such medium- term impacts,” he adds.

https://www.edgeprop.sg/property-news/singapore-budget-2018-buyer%E2%80%99s-stamp-duty-residential-properties-over-1-mil-rises-4

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles