1,080 private new homes sold in July, highest in 2020

By Valerie Kor

/ EdgeProp Singapore |

SINGAPORE (EDGEPROP) - Since the easing of circuit breaker restrictions on June 19, sales momentum of private homes has continued to pick up steam. A total of 1,080 new homes (excluding Executive Condominiums or ECs) were sold in July, up by 8.2% from 998 units sold in June and the highest since November last year. The figure is 8.4% lower y-o-y.

Despite the lack of major launches in July, Ismail Gafoor, CEO of PropNex Realty, notes that the market has continued to absorb units from previously launched projects at a pace that is “commendable given the substantial economic headwind from the pandemic”.

He attributes the higher sales figure to “underlying housing demand, ample liquidity in the system, low interest rates, and attractively priced projects”.

Advertisement

Deals were made for balance units at prior projects such as Treasure at Tampines (112 units sold), Parc Clematis (87 units sold), Jadescape (75 units sold) and Daintree Residences (56 units sold), observes Desmond Sim, head of research (Southeast Asia) at CBRE. He attributes the uptick in sales to anecdotal evidence of developer discounts and incentives, as well as a low-interest rate environment.

Top 10 best-selling private residential projects in July (excludings ECs)

Project | Units Sold | Region | Launch Date | Median Launch Price ($psf) | Median Price ($psf) in Jul-20 | Price Change (%) |

|---|---|---|---|---|---|---|

TREASURE AT TAMPINES | 112 | OCR | Mar-19 | $1,335 | $1,344 | 0.7% |

PARC CLEMATIS | 87 | OCR | Aug-19 | $1,615 | $1,649 | 2.1% |

THE FLORENCE RESIDENCES | 78 | OCR | Mar-19 | $1,434 | $1,559 | 8.7% |

JADESCAPE | 75 | RCR | Sep-18 | $1,667 | $1,739 | 4.3% |

DAINTREE RESIDENCE | 56 | RCR | Jul-18 | $1,699 | $1,641 | -3.4% |

PARC ESTA | 50 | RCR | Nov-18 | $1,703 | $1,710 | 0.4% |

THE TAPESTRY | 44 | OCR | Mar-18 | $1,408 | $1,365 | -3.1% |

STIRLING RESIDENCES | 38 | RCR | Jul-18 | $1,749 | $1,979 | 13.2% |

AFFINITY AT SERANGOON | 34 | OCR | Jun-18 | $1,590 | $1,534 | -3.5% |

THE WOODLEIGH RESIDENCES | 34 | RCR | Nov-18 | $2,007 | $1,875 | -6.6% |

Source: PropNex Research, URA

“Surprisingly, developers did not rush to launch new projects in the month of July before the seventh lunar month kicks in on Aug 19 to Sep 16,” says Ong Teck Hui, senior director of research and consultancy at JLL. The absence of new launches in July shows a hint of caution on the part of developers, he adds. However, some developers appear more confident, he says, pointing to an additional 400 units at Treasure at Tampines and 191 units at Avenue South Residences that were recently released for sale.

Ong notes that in August, Forett at Bukit Timah is the only new launch to date. The project sold 190 units, or 30% out of total units, during a virtual booking day event at an average psf price of $1,880 psf. PropNex’s Gafoor expects sales at Forett at Bukit Timah to “prop up overall new home sales in August”.

Tricia Song, head of research for Singapore at Colliers International, says that as of Aug 9, 543 new sales have been recorded this month. She expects sales to slow down after the 19th as the seventh lunar month is traditionally quieter for property sales.

Surge in sales in CCR

Sales in the Core Central Region (CCR) increased 43% m-o-m. Gafoor observes that this result may be spurred by right pricing strategy at projects including Kopar at Newton, Fourth Avenue Residences, The Avenir, and The M. At Kopar at Newton, one of the more popular launches in the CCR in July, the median transacted price was $2,292 psf in July, which is lower than the median price range of $2,600 to $3,400 psf transacted in District 9’s new launches in 2019, Gafoor observes.

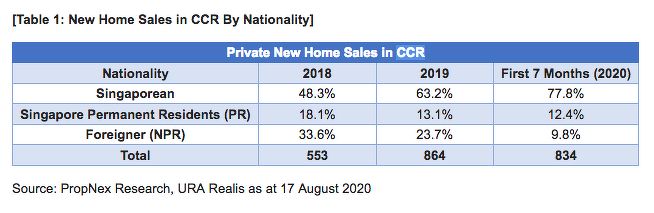

The percentage of local buyers in the CCR has also increased since two years ago, from 48.3% in 2018 to 63.2% in 2019. This year, Singaporeans contributed to 77.8% of total CCR transactions in the first seven months of 2020.

Advertisement

New home sales in CCR by nationality

Gafoor says: “This could be because of a pull-back in foreign purchases, following the increase in additional buyer’s stamp duty [ABSD] for foreigners in 2018 and, more recently, the travel bans due to the pandemic.”

Colliers International’s Song also observes that sales in the high-end luxury segment in the CCR maintained momentum in July. The Avenir moved 11 units at a median price of $2,992 psf, a 7.8% drop from the median price of $3,245 in January. Cuscaden Reserve sold three units at a median price of $3,622 psf, while Boulevard 88 sold two units at a median price of $3,489 psf.

Still, the mass market segment leads the majority of private home sales. Leonard Tay, head of research at Knight Frank Singapore, says that excluding ECs, the majority of units transacted in July were in the Outside Central Region (OCR), which accounted for 548 units. There were 419 transactions in the Rest of Central Region (RCR) and 113 deals in the CCR.

Higher-quantum units sold

CBRE’s Sim notes that there is an increased interest in higher-quantum units in July, where 147 homes were sold at above $2 million. This figure is up from 118 in June. “Buyers with liquidity are still seeking opportunities in the residential market, motivated by the low-interest rate environment and increased incentives offered by developers,” says Sim.

Even as the majority of buyers bought homes in the suburban and city-fringe areas in July, sales of landed properties and pricier homes rose last month, notes Christine Sun, head of research and consultancy at Orange Tee & Tie.

Source: URA, OrangeTee & Tie Research & Consultancy

“This came as a surprise as most buyers, especially those purchasing homes in the mass market region would be expected to prefer more affordable housing options, given the current macroeconomic uncertainties,” she says.

Advertisement

Sun also highlights two top deals in the RCR made at above $10 million: a 5,672 sq ft unit at Meyer House that was sold for $13.8 million ($2,434 psf) and a 4,973 sq ft unit at 15 Holland Hill that transacted for $13.4 million ($2,700 psf). “The increasing demand for such luxurious homes attests to the resilience and attractiveness of residential properties in Singapore,” she adds.

Average size of new homes purchased (April–August 2020)

April | May | June | August | |

|---|---|---|---|---|

Average size (sq m) | 72.7 | 73.3 | 80.9 | 83.7 |

Source: URA caveats, Huttons Research

Singaporeans form majority of buyers

The number of new, non-landed homes (excluding ECs) bought by Singaporeans rose further from 785 units in June to 884 units in July, which constitutes 84.4% of total new non-landed homes, comments Orange Tee & Tie’s Sun.

The number of homes bought by Singapore permanent residents (PR) rose further from 123 units in June to 130 units in July, while those bought by foreigners fell slightly from 46 units in June to 34 units in July, she adds.

At top-selling projects Treasure at Tampines, Parc Clematis and The Florence Residences, 85% of the units sold at these projects were bought by Singaporeans, 13% by PRs and 2% by foreigners, notes Knight Frank’s Tay.

Sun adds that for non-landed new private homes (excluding ECs) that were sold above $2 million in July 2020, 76% (114 units) were bought by Singaporeans, 18.7% (28 units) by PRs and 5.3% (8 units) by foreigners.

CBRE’s Sim concludes that the impact of Covid-19 is not immediate and a slowdown of sales momentum could be seen in 2H2020, following weak economic sentiment and employment figures. He predicts that new home sales volume may reach about 7,000 units, excluding ECs, for the whole of 2020.

However, other consultants are more optimistic. Knight Frank’s Tay projects total new home sales to hit 7,000 to 8,000 for 2020, while Orange & Tee’s Sun projects that around 7,500 to 8,500 new private homes could be sold this year.

Check out the latest listings near Treasure at Tampines, Daintree Residences, Jadescape, Avenue South Residences, Kopar at Newton, Fourth Avenue Residences, The Avenir, The M, Kopar at Newton, Cuscaden Reserve , Boulevard 88, Meyer House and 15 Holland Hill

Read also:

https://www.edgeprop.sg/property-news/1080-private-new-homes-sold-july-highest-2020

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles