Collective sale momentum to continue in 2018

Even as the year draws to a close, sites are still being launched for collective sale. On Dec 19, the 76-unit Casa Meyfort, which occupies a prime freehold site on Meyer Road, was launched for tender. The reserve price for the 85,249 sq ft site, which has a plot ratio of 2.8, was set at $340 million ($1,616 psf per plot ratio). Edmund Tie & Co is the marketing agent.

Savills Singapore plans to launch The Wilshire for collective sale at end-December. The 20-unit condo sits on a 39,130 sq ft, freehold site on Farrer Road in prime District 10 and has a plot ratio of 1.6. It can be redeveloped into a 12-storey condominium with gross floor area of about 64,310 sq ft.

In early January, Savills will be launching Sixth Avenue Centre for sale. The existing development comprises seven strata shop units and 18 apartments. The freehold mixed-use complex is located on Bukit Timah Road, just 150m from the Sixth Avenue MRT station. It can be redeveloped into a new project with a 40% commercial component and 60% residential component.

Advertisement

Collective sale sites near future MRT stations on the Thomson-East Coast Line present ‘exciting redevelopment potential’, which is likely to appeal to both developers and future homebuyers, says Colliers’ Tang (Credit: Samuel Isaac Chua/The Edge Singapore)

Small, freehold sites to dominate

Next year, smaller freehold sites are likely to dominate the en bloc scene, says Alan Cheong, head of research for Savills Singapore. He reckons the majority of en bloc deals done next year are likely to be “less than $300 million”, with just a few reaching the $500 million-to-$600 million range.

In addition to The Wilshire and Sixth Avenue Centre, Savills is also the appointed marketing agent for two other freehold sites, which have garnered about 70% consensus to proceed with a collective sale, says Suzie Mok, Savills Singapore senior director of investment sales. They are the 34-unit Minbu Villas on Minbu Road in prime District 11 and the 48-unit Hollandia on Holland Road in prime District 10.

Knight Frank is also handling several freehold projects that are at an advanced stage in the collective sale process: the 89-unit Kemaman Point in Balestier; 210-unit Goodluck Garden on Toh Tuck Road; 114-unit Dunearn Gardens on Dunearn Road; and 200-unit Windy Heights on Jalan Daud in the Kembangan area.

The queue of collective sale hopefuls continues to lengthen. There are 80 to 90 at various stages in the process. “I won’t be surprised if there are at least 100 by January 2018,” says Ian Loh, Knight Frank Singapore executive director and head of investment and capital markets.

En bloc market still main source of sites

With only six residential sites available on the Confirmed List of the 1H2018 government land sales programme and developers still trying to secure sites to capitalise on the market recovery, “the en bloc market will remain the main source of land supply next year”, says Ong Teck Hui, JLL national director of research and consultancy.

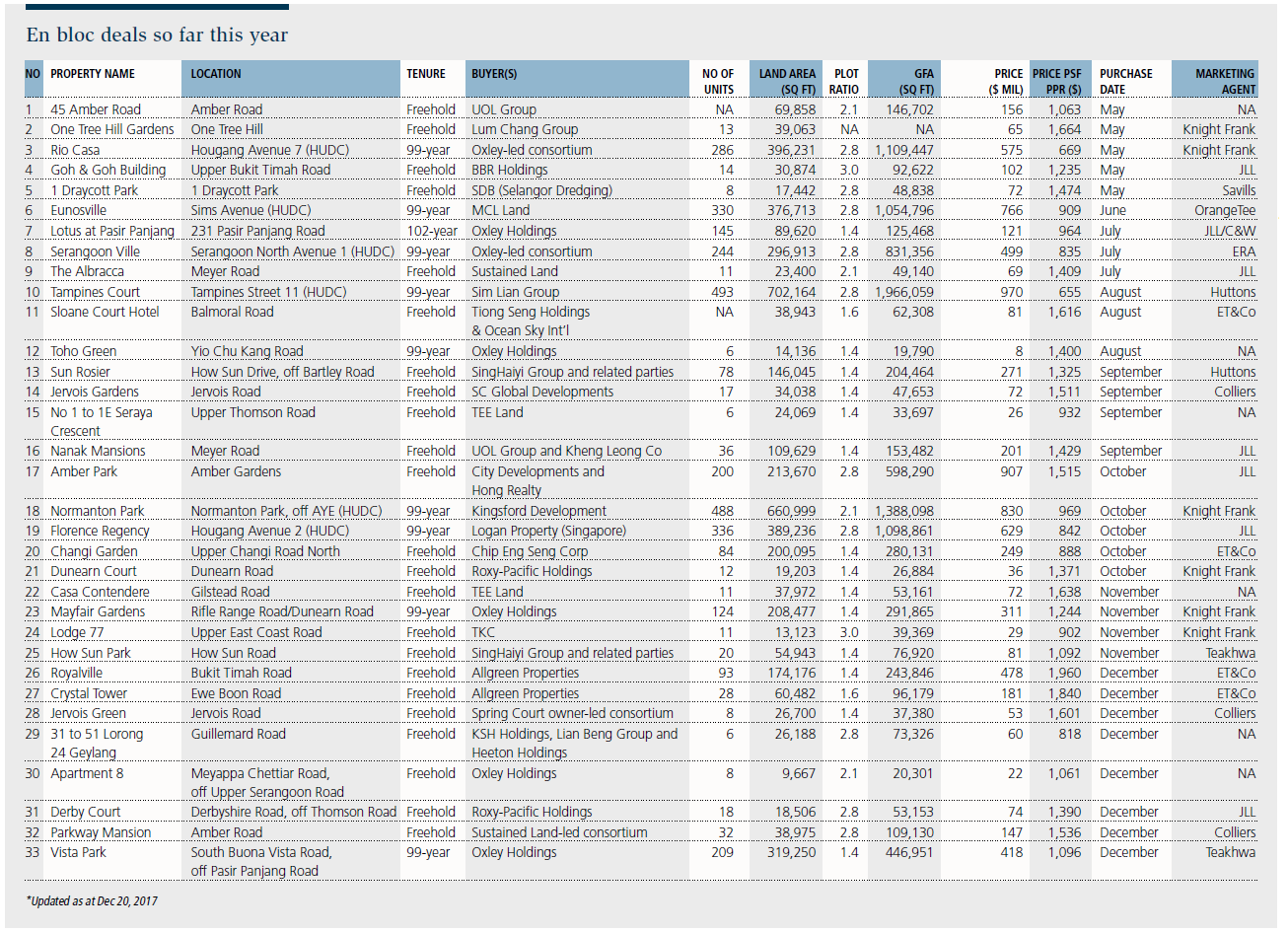

So far this year, 33 sites with a total value of $8.63 billion have been sold en bloc. If only collective sales were included, the figure would be $7.6 billion (see chart). “We could still see a strong volume of en bloc sales in 2018, but the sales volume could be affected by a mismatch in pricing expectations between buyer and seller, leading to failed transactions,” says Ong.

Advertisement

Sites near MRT stations on Thomson-East Coast Line remain popular

A key trend that will influence the collective sale market in 2018 will be the ongoing efforts to enhance the public transport system, says Tang Wei Leng, managing director of Colliers International. “I expect developers to assess collective sale sites based on the opportunities created by upcoming infrastructure developments such as the Thomson-East Coast Line.”

Collective sale sites near future MRT stations on the Thomson-East Coast Line present “exciting redevelopment potential”, which is likely to appeal to both developers and future homebuyers, adds Tang.

“The changing demographic profile of the population is another trend that could shape the collective sale market in 2018,” she continues. “Sites near good schools will continue to find favour with developers, as the future development will be attractive to homebuyers with school-going children.” Tang sees good collective sale opportunities in prime District 10, especially the Holland Road/Bukit Timah area, “where homes can be resized to cater to demographic changes”.

More hurdles for large, leasehold sites

So far this year, six privatised HUDC estates have been sold en bloc for a total of $4.3 billion, the largest of which is Tampines Court, sold to Sim Lian Group for $970 million and considered the largest collective sale this year in terms of deal size and number of units involved (493 units).

Most of the large privatised HUDC estates sold were in the Serangoon and Hougang areas in District 19: Florence Regency ($629 million), Rio Casa ($575 million) and Serangoon Ville ($499 million). Two freehold sites in the northeast region that were sold en bloc were How Sun Park ($81.09 million) and Sun Rosier ($271 million).

“Part of the reason for [the high number of en bloc deals in the northeast region this year] is the improvement in infrastructure, regeneration taking place in the neighbourhoods, and new train stations on the Circle Line that help connect to the North-East Line, making the residential areas more accessible,” says Knight Frank’s Loh. “Ten years ago, all these amenities were not in place yet. For people living in the Hougang, How Sun and Serangoon areas, it means greater connectivity and convenience, which is reflected in the property prices, especially for the en bloc sale beneficiaries.”

Advertisement

While the collective sale fever this past year was stoked by the 99-year leasehold sites in the suburbs, the chief valuer has caught up by raising development charges of up to 29% in areas in the northeast region such as Hougang, Tampines Road and Punggol, notes Desmond Sim, CBRE head of research for Singapore and Southeast Asia. Developers have to take into consideration the differential premiums payable for topping up the lease too, he adds.

Sources: Morgan Stanley Singapore, Various property consultants

Traffic feasibility study increases uncertainty for developers

On Nov 13, URA announced that, with immediate effect, it was mandatory for all buyers of collective sale sites to submit a pre-application feasibility study on traffic impact, along with their outline development applications for the site. This could curb developers’ demand for large privatised HUDC estates, adds Savills’ Cheong. “It may therefore be difficult to pull off one of those en bloc deals the size of Rio Casa or Eunosville, which can yield about 1,400 units. This will have a chokehold on developers in terms of the number of units they can develop on the site, and will crimp their profits.”

One of the first to be affected by the pre-application traffic feasibility study is Pearl Bank Apartments, which was put up for tender at end-October at a reserve price of $728 million. The collective sale tender closed on Dec 19. It is said to have “attracted keen interest from developers”. The collective sale committee is now evaluating its options and taking into account the concerns raised by interested parties.

“Developers’ concerns include uncertainties arising from the pre-application feasibility study on traffic impact, which will affect the number of units that can be built on the site and the approach to pricing land, as well as apprehension over whether they would be compelled to conserve the iconic development in the future,” says Colliers’ Tang.

As such, the collective sale committee of the development has instructed Colliers, its marketing agent, to enter into private-treaty negotiations with interested parties. According to laws governing collective sales, the owners may enter into a private-treaty contract with a buyer within 10 weeks from the close of the public tender, adds Tang.

If a leasehold site is in a good location and the asking price is realistic, developers are likely to remain keen, says Ong Choon Fah, CEO of Edmund Tie & Co.

This article appeared in EdgeProp Pullout, Issue 811 (Dec 25, 2017).

https://www.edgeprop.sg/property-news/collective-sale-momentum-continue-2018

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles