Hong Kong retailers stage unprecedented strike in 14 shopping centres to demand lifeline as foot traffic plunges amid coronavirus outbreak

By Lam Ka-sing kasing.lam@scmp.com

/ https://www.scmp.com/business/article/3051091/retailers-stage-unprecedented-strike-14-hong-kong-shopping-centres-plead?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp |

Fifty retailers shut their fashion outlets, restaurants and cafes in Hong Kong on Tuesday in an unprecedented strike to demand rental cuts, as plunging foot traffic caused by months of anti-government protests and a coronavirus outbreak threatens to decimate the industry.

Confectioner Lady M, the French sportswear brand Lacoste distributed by Crocodile and Singapore's fashion brand Club 21 are among nearly 200 shops that have declared a "no business" day across 14 shopping centres in Hong Kong. Some of the shops said they would be shut for 24 hours, while others announced temporary closures without stating a time limit.

"The last seven months of losses have become unbearable for many of us," said Ashley Micklewright, president and chief executive at Bluebell Group, a distributor of luxury brands including Moschino, Davidoff and Anya Hindmarch. "The impact on the business and traffic is far worse than anything we have ever experienced."

Advertisement

Hong Kong's retailers, hotels and restaurateurs are taking the brunt of the city's economic woes, with some stores losing as much as 90 per cent in sales compared with last year, as average daily arrivals plunged to 3,000 in February from 200,000 in the first half of 2019. Some of them have joined forces to press their landlords into cutting their rent.

Commercial real estate leases in Hong Kong are usually made up of two parts: a "base" rent, which is the minimum fixed charge the tenant pays to the landlord, and an additional rent which is usually a percentage of the shop's sales. The striking retailers are demanding that their landlords waive their base rent during the current crisis, as the city's economy finds itself in the first technical recession in a decade.

"The last thing we want to do is to shut down something that took a few decades and three generations to build, let alone lay off our employees," said Micklewright, whose group earned US$50 million in sales in 2018 through 22 outlets in 19 shopping centres in the city.

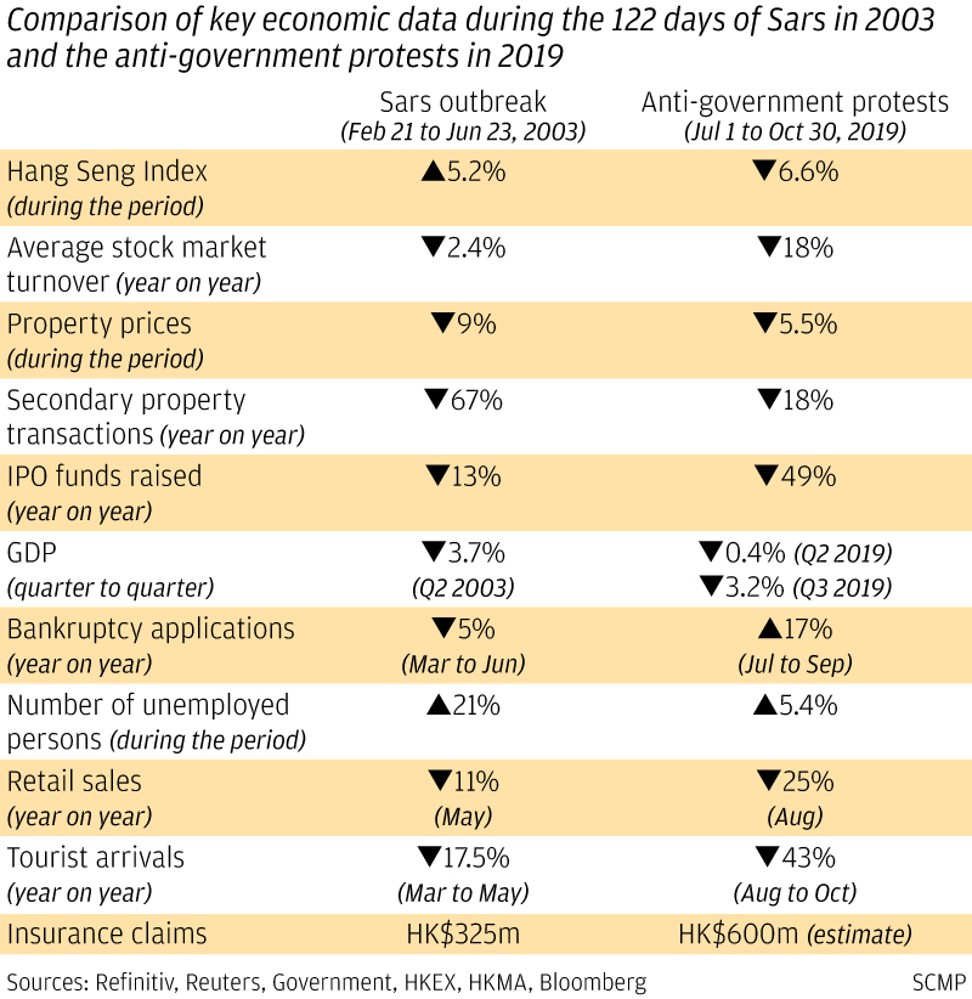

SCMP Graphics alt=SCMP Graphics

Tuesday's strike affected 14 shopping centres all over Hong Kong, including Wharf Real Estate Investment's Harbour City, New World Development's K11 Musea in Tsim Sha Tsui, Sun Hung Kai Properties' New Town Plaza in Sha Tin, and the IFC Mall in Central by Sun Hung Kai, Henderson Land Development and Town gas.

Some commercial real estate landlords have already announced rental relief to help the smallest of their tenants weather the decline in foot traffic.

Henderson, the city's third-biggest developer, offered to cut rent by 60 per cent to help retailers and save jobs. Hong Kong's toy billionaire Francis Choi Chee Ming offered to cut the rent at a 15,000 sq ft space at Plaza 2000 in Causeway Bay by 44 per cent, after Prada balked at paying HK$9 million in monthly charges.

Advertisement

"Even if you give a 15 per cent deduction, in terms of amount it's peanuts," said Micklewright, because the average monthly commercial lease price in Causeway Bay, at HK$500 per square foot in shopping centre, stands among the highest in the world. "It's not going far enough."

A shop is closed at IFC mall in Central on 18 February 2020. About 200 shops under about 50 retailers join this silent protest for scrapping base rent amid of the coronavirus outbreak. Photo: Jonathan Wong alt=A shop is closed at IFC mall in Central on 18 February 2020. About 200 shops under about 50 retailers join this silent protest for scrapping base rent amid of the coronavirus outbreak. Photo: Jonathan Wong

Most landlords had been slow and unforthcoming in helping tenants, several of the striking retailers said, offering little in the way to help the industry pull through the current slump or avoid lay-offs. Some of the retailers say they have up to 800 employees on staff.

Some retailers are shutting down outlets in Hong Kong for good, or pulling out altogether, driving the vacancy rate on Russell Street " for many years the world's most expensive main street, surpassing Fifth Avenue in New York and Avenue des Champs-Elysees in Paris " to 10 per cent.

Apart from Prada, Louis Vuitton was shutting its Times Square outlet while J. Crew has said it would shut both its outlets in Hong Kong. At Harbour City, walking distance from the luxurious Peninsula hotel in Tsim Sha Tsui, as many as 24 shops now stand vacant.

"As a business owner, our main concern is to protect our team. We are truly hoping that we can find a proper solution and not a short term patch to get us out of this situation," said Ariane Zagury, co-founder of the Rue Madame Fashion Group, which operates 28 stores in Hong Kong, Singapore and Macau. "If not, a large number of the SMEs will no longer be on the market very soon and large groups will consequently reduce their exposure to Hong Kong."

In Singapore where the retailing industry is also facing a torrid time, shopping centres also typically charge base rent plus a percentage of the gross turnover.

Advertisement

"I don't think landlords are in the business to allow much flexibility for tenants because they also depend on constant cash flow to sustain the loan repayment and leasing expenses," said Christine Li, head of research of Singapore and Southeast Asia at Cushman& Wakefield.

"Sometimes in a bad retail environment, tenants can go back to landlords to negotiate some rent free, although it's not that common," she said. "Tenants can consider breaking the leases if the business really cannot continue."

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2020 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2020. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/hong-kong-retailers-stage-unprecedented-strike-14-shopping-centres-demand-lifeline-foot-traffic

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles