How much upfront cash do you need to buy a Singapore condo now?

By EdgeProp Singapore

/ EdgeProp |

The latest rounds of property cooling measures announced in early July has made buying private properties in Singapore more expensive than ever.

Stamp duty for Singaporeans and permanent residents buying their second or subsequent properties, and foreigners buying residential property will see increases of 5 percentage points from 6 July 2018.

How much cash do you need for your down payment now with the new cooling measures? What are some other miscellaneous charges involved in your condo purchase, and when can you use your Central Provident Fund (CPF)?

Advertisement

Assuming you meet the Total Debt Servicing Ratio (TDSR) framework, here’s the minimum amount of upfront cash you will need to fork out based on your loan amount, and also the stages of payment in which you can use your savings in your CPF Ordinary Account (OA) to purchase private residential property.

In this article, we look at two common scenarios:

1) A Singapore Citizen buying a first residential property

In this scenario, we assume you are a Singapore citizen buying your first property. One project that is particularly popular with Singaporean buyers is the 729-unit The Tre Ver. The leasehold project in Potong Pasir drew a crowd of 3,000 on the first day of its preview despite the recent cooling measures.

The Tre Ver is located at Potong Pasir Avenue and will overlook the Kallang River. Designed by WOHA – a Singapore-based architectural practice renowned for their integration of environmental and social principles in their designs – most of the existing trees lining the project’s riverfront will be preserved throughout the various stages of its development.

The crowd at The Trever in the afternoon on the first day of preview (Credit: UOL Group)

If you’ve had your sights set on a three-bedroom unit at the project, which is priced at around $1.5 million, here’s a breakdown of how much you will have to pay in cash and/or with your CPF at different stages of your property purchase.

*Figures provided are mere estimates and should not be used for official purposes.

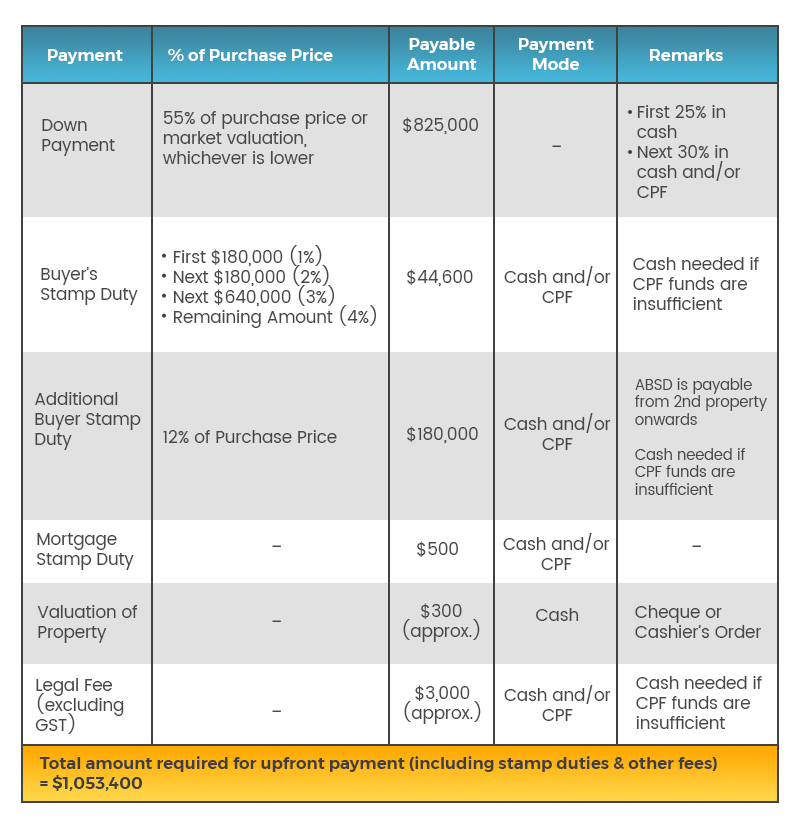

2) A Singapore Citizen buying a second residential property

In this second scenario, we assume you are a Singaporean buying your second property and currently financing an existing property. If you’re keen to buy a three-bedroom unit at The Tre Ver, priced roughly at $1.5 million, here’s the breakdown of the initial cash outlay and CPF required at the various stages of your property buying process.

The Tre Ver is located at Potong Pasir Avenue and will overlook the Kallang River

*Figures provided are mere estimates and should not be used for official purposes.

But first..watch that housing budget!

Many people purchase private property with the intention to upgrade from their current homes or as an investment vehicle to collect rental income. But because buying a home is such a huge financial commitment, it is crucial that you first consider your housing budget before taking the next step.

Advertisement

To do this, you need to first consider your housing budget before you even kick-start your property search. Most experts suggest that you shouldn’t be spending more than 30% to 40% of your gross monthly income on housing.

It’s not just that, looking at properties that cost way beyond what you can afford is both time-wasting and frustrating, and can hamper your overall search for a suitable property.

To simplify your search, we’ve come up with a brief guide on how much new and resale condos cost across different locations in Singapore. For the purpose of this article, we only looked at transactions from 1H2018 to derive the average $ psf price. We assumed that all units are 900 sq ft.

Market region | New Sale | Resale |

|---|---|---|

Core Central Region | $2.54 mil ($2,820 psf) | $1.57 mil ($1,740 psf) |

Rest of Central Region | $1.61 mil ($1,793 psf) | $1.27 mil ($1,413 psf) |

Outside Central Region | $1.26 million ($1,399 psf) | $973,800 ($1,082 psf) |

Source: URA, EdgeProp.sg

*Figures provided are mere estimates and should not be used for official purposes.

Unaffected by the new ABSD rates and looking to stake a claim to Singapore’s private home market? Don’t miss out on these popular new entry-level condos!

https://www.edgeprop.sg/property-news/how-much-upfront-cash-do-you-need-buy-singapore-condo-now

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles