Bad news for Shenzhen housing speculators as officials steer home prices below market levels

By Lam Ka-sing kasing.lam@scmp.com

/ https://www.scmp.com/business/article/3122779/bad-news-shenzhen-housing-speculators-officials-steer-home-prices-below?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp&utm_content=3122779 |

Shenzhen's local government is seeking to stem a housing market bubble in the city by setting "reference prices" for lived-in homes at below market levels, a move that is expected to squeeze mortgage financing for homebuyers.

The Housing and Construction Bureau on February 8 disclosed the indicative prices for 3,595 lived-in residential estates in the city dubbed as China's Silicon Valley, following a series of administrative curbs last year to tame the market.

The reference prices are about the same levels as those marked in new launches, and about 10 to 40 per cent below those cited in the secondary market, analysts said. This may chill demand as banks tighten mortgage loan financing based on lower valuations and homebuyers are forced to come up with higher down payment, they added

Advertisement

Get the latest insights and analysis from our Global Impact newsletter on the big stories originating in China.

"This policy is quite hawkish to the Shenzhen's housing market," said Raymond Cheng, a managing director at CGS-CIMB Securities. "In the short term, secondary market transactions will be frozen."

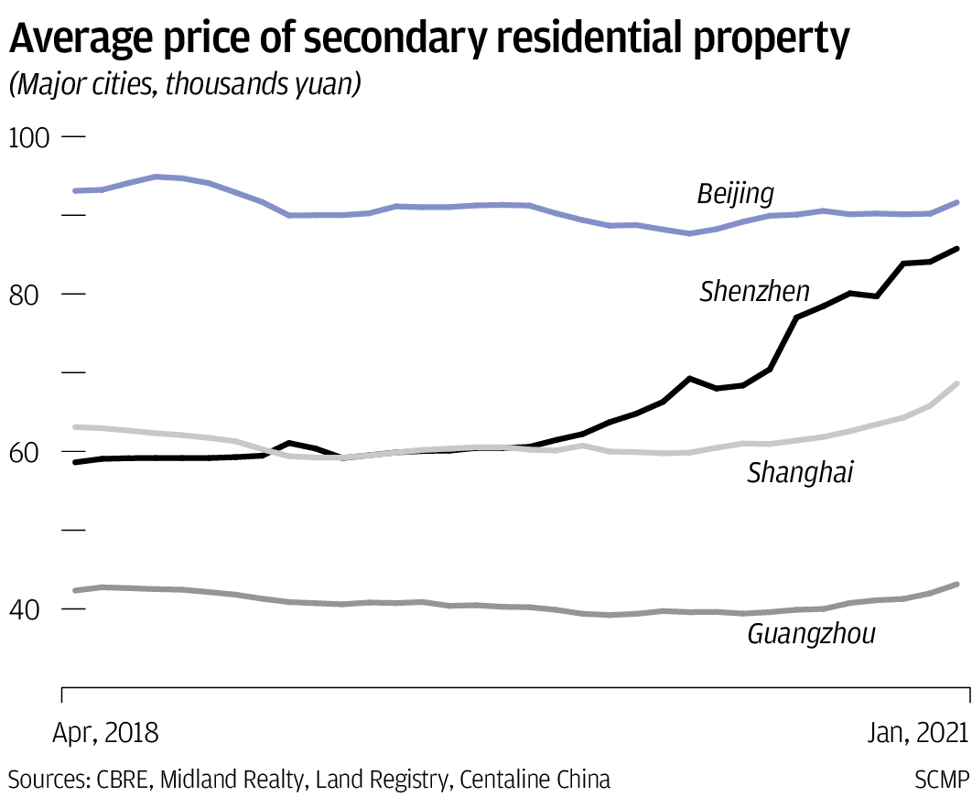

Shenzhen home price increase outpaces major Chinese cities alt=Shenzhen home price increase outpaces major Chinese cities

China's economic recovery from the Covid-19 pandemic has also underpinned confidence in spending. New home prices in 70 major cities rose 0.28 per cent in January from December, the government said on Tuesday. Secondary market prices rose 0.37 per cent, the most in 18 months.

Shenzhen is the wealthiest city in southern Guangdong province and home to some of the nation's biggest companies including Tencent Holdings and Huawei Technologies. Prices surged 48.4 per cent in February from two years earlier, compared with 3.8 per cent in Beijing, 9.2 per cent in Guangzhou and 22.6 per cent in Shanghai, according to data compiled by real estate agencies.

The Shenzhen government may be winning the battle. At least three banks - China Construction Bank, Bank of Beijing and Bank of Communications - have adopted its reference prices as the basis for vetting mortgage loan applications, local media outlet Cailianshe reported last week.

The lenders did not immediately reply to email requests for comments from the Post on Tuesday.

The housing bureau's list pegs the first three phases of Huaruncheng project in Nanshan at 132,000 yuan (US$20,425) per square metre, matching the level when its developer China Resources launched the fourth phase in November last year.

Advertisement

Those units were quoted at about 170,000 to 180,000 yuan in the second half of last year, and briefly reached a record of about 200,000 yuan in October, according to data compiled by real estate agencies.

"There may be other banks following the government's requirement to use reference prices in approving home loans," said Danielle Wang, head of China property team at DBS Bank. Lower mortgage financing will increase down payment requirements and lower risks for banks, she added.

Cheng at CGS-CIMB Securities said the city's tenacity reflects local officials' concerns about the "political risks" of failing to combat market excesses. China has pledged to maintain housing for dwelling and not for speculation.

The disconnect between the official reference prices and market-determined prices might prompt homebuyers to hold back their spending plans pending policy clarity, according to Andy Lee, chief executive for southern China at Centaline. Transaction volume in Shenzhen could plunge by 20 to 30 per cent in the coming three months and prices may fall by as much as 5 per cent, depending on banks' lending policy, he said.

At the same time, homeowners have also adopted a wait-and-see attitude because of the price pressures despite a buoyant market outlook, while property agents avoided publicising [listing] prices due to the wide gaps.

Homeowners may not be willing to slash prices and sell homes at levels suggested by the reference prices, Lee said. The Shenzhen economy is doing relatively well as the technology sector and several large IPOs have created a lot of equity wealth effect, he added.

Advertisement

That purchasing power may be behind the average 14.1 per cent jump in secondary market home prices in Shenzhen last year, the biggest surge among major Chinese cities, according to the National Bureau of Statistics.

Other cities experiencing similar sharp price increases, such as Chengdu and Hangzhou, could replicate Shenzhen's initiatives, said Li Yujia, a senior economist at Guangdong Urban and Rural Planning and Design Institute, a provincial policy advisory unit.

"If the bank follows the reference prices as valuations for [mortgage] loans, then there would be steep declines in [mortgage] loan valuations," Li added. "The impact on home prices would be significant."

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2021 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2021. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/bad-news-shenzhen-housing-speculators-officials-steer-home-prices-below-market-levels

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles