Real estate moguls with a Greece-size debt problem look for hints of relief, even as China's legislature tries to wean industry off its loans

By Pearl Liu pearl.liu@scmp.com

/ https://www.scmp.com/business/china-business/article/3122643/real-estate-moguls-greece-size-debt-problem-look-hints?utm_medium=partner&utm_campaign=contentexchange&utm_source=EdgeProp&utm_content=3122643 |

In the second part of a series looking at China's forthcoming legislative meetings, known as the Two Sessions, we look at how China's real estate developers, among the biggest debtors in the country, are looking for hints of relief as 15 of them sit through the proceedings that begin next week. The first part of the series is here.

China's property developers, who replaced managers of decrepit state-owned factories as the nation's largest debtors, will be in the hot seat when they show up next week at the Great Hall of the People for their annual legislative meeting in Beijing.

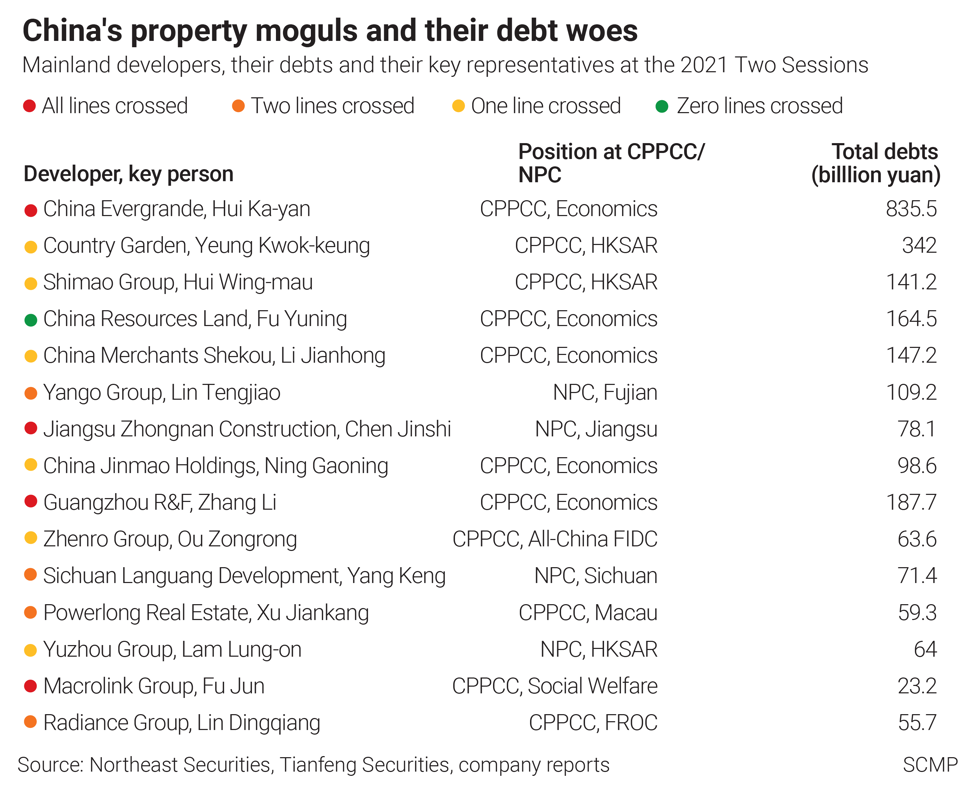

Fifteen of the 5,138 delegates attending the Two Sessions are real estate developers, owning or heading property companies with 2.44 trillion yuan (US$377 billion) of short-term borrowings and long-term loans between them, more than the debt that brought the Greek economy to its knees in 2008, according to calculations by South China Morning Post based on financial filings.

Advertisement

Get the latest insights and analysis from our Global Impact newsletter on the big stories originating in China.

The moguls, the wealthiest of whom is Evergrande Group's chairman Hui Ka-yan - with US$25.5 billion in estimated fortunes as China's 14th-richest person - may be in the cross hairs of the legislature, as delegates are expected to march to the government's beat to maintain financial stability while the economy claws its way out of the coronavirus pandemic.

"They have to present a doable solution at the Two Sessions, showing how they are going to reduce their debt and what their schedules are," said Phillip Zhong, senior equity analyst at Morningstar.

"They need to give their word to the central government that they can get there at some point, and will not be the ones that bring systematic risk to the country's economy, which is the biggest concern of Beijing right now."

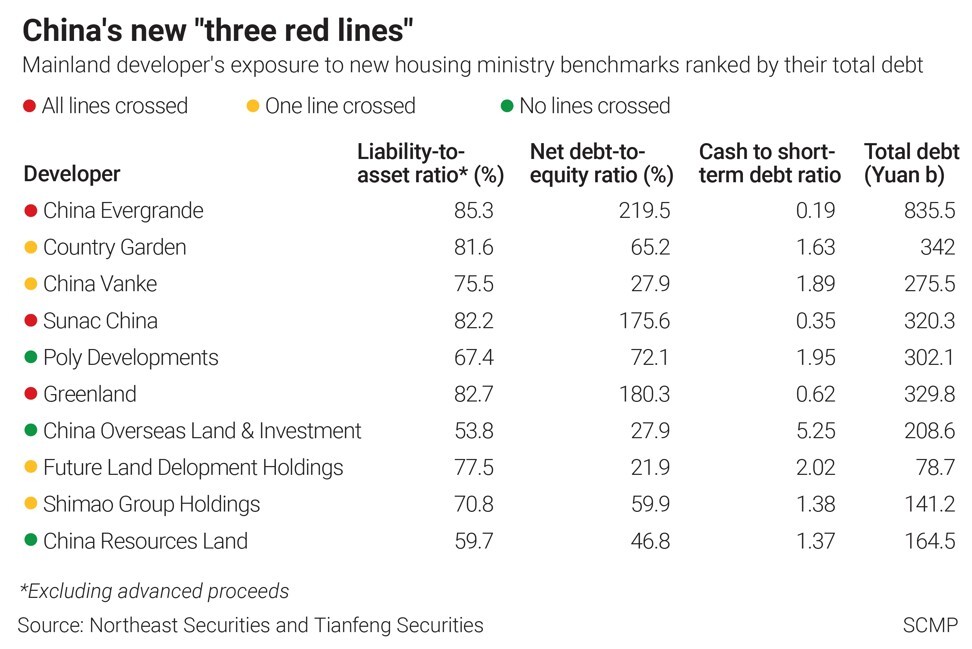

Chinese developers and the central bank's three 'red lines' alt=Chinese developers and the central bank's three 'red lines'

That may be a tall order. All but one of the 15 developers represented at the National People's Congress (NPC) and the Chinese People's Political Consultative Conference (CPPCC) are in breach of one, if not all, of the Chinese central bank's so-called Three Red Lines of capital requirements.

Four of them - including Hui's Evergrande - are designated red, having crossed all three lines, and are barred from taking on any new loans. Four are designated orange for blowing two of the caps and six are classified yellow for one breach. Only China Resources Land, a state-owned developer headquartered in Shenzhen, is in the green as its 164.5 billion yuan in borrowings fall within the allowable levels of the People's Bank of China.

Advertisement

NPC and CPPCC delegates at the Two Sessions can recommend policies that may eventually be enacted into legislation. Being at the centre of China's legislative process also give them front-row seats to see where government policies are headed. The tycoon delegates will look for clues of whether the central bank will maintain its tight cap on borrowings, and may even recommend policies that walk the tight rope between pleading for breathing space for their debt-fuelled industry, without causing the loans to blow out.

Property tycoons at the Two Sessions meetings. SCMP Graphics alt=Property tycoons at the Two Sessions meetings. SCMP Graphics

Jiangsu Zhongnan Construction Holdings, classified red according to the central bank with 78.1 billion yuan owed, was the only one of the 15 delegates that responded to queries by the Post.

Chen Jinshi, the Zhongnan chairman who also represents Jiangsu province at the NPC, is still preparing his proposals for the Two Sessions, according to an emailed response.

"Under the current circumstances, we will further improve the company's turnover rate and further reduce our reliance on debts," Zhongnan said.

Four decades of rapid economic growth have turned the communal housing of Mao Zedong's era into some of the world's tallest apartments, biggest private housing estates and most opulent villas, in the process turning China's property market into the largest on earth, with last year's sales value of new homes topping US$2.7 trillion.

Chen Jinshi, chairman of Jiangsu Zhongnan Construction Holdings, and NPC delegate for Jiangsu province. alt=Chen Jinshi, chairman of Jiangsu Zhongnan Construction Holdings, and NPC delegate for Jiangsu province.

Average prices surged fivefold in the past 20 years, turning Evergrande's Hui, Country Garden Holdings' co-chairman Yeung Kwok-keung, Shimao Group's Hui Wing-mao and more than 100 of them into dollar-denominated multibillionaires, the world's largest congregation of property tycoons, according to the 2019 Hurun Report .

Advertisement

But China's real estate industry is mostly financed by borrowings, partly the result of a government effort to cap oversupply, which barred developers from selling homes off the plan. That turned the industry towards bank loans, bonds and any financial instrument that can fund their construction and land purchases.

Over the decades, the loans built up. When local authorities enacted policies in mid 2017 to tame runaway home prices, the ever more stringent mortgage and marketing policies began to crimp the developers' revenue, affecting their ability to repay their loans and bond commitments.

By 2020, debt soared to a record among developers. This year, the total due will increase by another 36 per cent to 1.2 trillion yuan, Beike Research Institute said.

New apartment blocks coming up next to paddy fields on the outskirts of Shanghai, on Monday, April 17, 2017. Photo: Bloomberg alt=New apartment blocks coming up next to paddy fields on the outskirts of Shanghai, on Monday, April 17, 2017. Photo: Bloomberg

"They should expect no mercy from top officials. They were selected to set examples to their peers, not to receive special treatment," said Li Yujia, chief researcher at the Guangdong Property Policy Research Institute. "The government has made up its mind to completely change the heavy reliance on property and [is] unwilling to see money rushing back into it. The key message is loud and clear - China is geared up for boosting manufacturing and hi-tech industries, not selling homes. The [policy] stance could be reaffirmed more clearly at the Two Sessions."

To forestall the implosion of the debt build-up and prevent any damage from blowing out China's financial system at a time of slowing economic growth, the central bank slapped some of its most draconian credit curbs on developers since late last year.

The central bank introduced a five-tier grading system from January 1, tieing the amount banks could lend towards property-related loans to their capitalisation. These work with the Three Red Lines to pre-empt money needed for kick-starting the economy from being diverted into real estate speculation.

Li Jianhong, ex-chairman of China Merchants Group, the parent company of China Merchants Shekou Industrial Zone Holdings, and a delegate to the economics section of the CPPCC. alt=Li Jianhong, ex-chairman of China Merchants Group, the parent company of China Merchants Shekou Industrial Zone Holdings, and a delegate to the economics section of the CPPCC.

With this one-two punch, the central bank must take extra care to avoid starving the property industry to death while they channel financial resources to other sectors, analysts said.

"The intention is the stable growth, not to kill the housing sector, which is still a key contributor to the economy," said Moody's Corporate Finance Group's associate managing director Franco Leung. "Developers still get two to four years to comply with the deleveraging requirements. Large, but highly indebted developers have room and time to cut their debt through discount marketing, asset sales or equity fundraising."

That exercise is already under way. Evergrande, with a third of the debt owed by the 15 developers, is typical of the shift.

The company, China's largest property seller by volume, launched three nationwide rounds of discounts last year, slashing prices across 800 property projects by up to 30 per cent. Its first project in Hong Kong, the Emerald Bay apartments in Tuen Mun, mostly flopped after a successful launch soon fizzled out amid fierce competition.

Lin Tengjiao, founder and chairman of the Yango Group, and a delegate to the NPC representing Fujian province. alt=Lin Tengjiao, founder and chairman of the Yango Group, and a delegate to the NPC representing Fujian province.

Still, that did not stop the Shenzhen-based company from reporting a 20 per cent increase in its 2020 revenue to 723 billion yuan, giving Evergrande some breathing room on its 835.5 billion yuan of debt. Evergrande has set a target of selling 750 billion yuan of homes this year.

The company's chairman, also known as Xu Jiayin in China, is also spinning off valuable assets from his portfolio to raise funds in the equity market. Its subsidiary Evergrande Property Services Group raised HK$14.27 billion in a November initial public offering (IPO) in Hong Kong, while its Evergrande New Energy Vehicle Group unit raised HK$4 billion in a top-up offering two months earlier. Last month, the electric car maker raised HK$26 billion from six of Xu's tycoon friends through selling new shares.

Hui Ka-yan, also known as Xu Jianyin in mainland China, during the opening ceremony of the new home court of the Guangzhou Evergrande Taobao team for the Chinese Football League in Guangzhou on 16 April 2020. Hui is a CPPCC delegate in the economics section. Photo: Imagine China alt=Hui Ka-yan, also known as Xu Jianyin in mainland China, during the opening ceremony of the new home court of the Guangzhou Evergrande Taobao team for the Chinese Football League in Guangzhou on 16 April 2020. Hui is a CPPCC delegate in the economics section. Photo: Imagine China

The fundraising plans were effective. Evergrande slashed its loans by 160 billion yuan as of January, two months ahead of schedule, and redeemed a HK$16.1 billion convertible bond before its February 10 deadline.

"We expect the company to at least improve its grade to orange, if not yellow, by end of the this year," said CGS-CIMB Securities' property analyst Raymond Cheng, who has kept an "add" recommendation on Evergrande shares since March 2018.

Other developers have also sold assets to repay their loans. Hong Kong-listed Agile Group Holdings raised 7.05 billion yuan in December by selling stakes in seven property projects to Ping An Insurance Group.

Ou Zongrong, founder of Zhenro Group, and a CPPCC delegate representing the All-China Federation of Industry and Commerce, an industry guild. alt=Ou Zongrong, founder of Zhenro Group, and a CPPCC delegate representing the All-China Federation of Industry and Commerce, an industry guild.

Guangzhou R&F Properties raised US$1.1 billion by selling 70 per cent of a logistics park to Blackstone in January, after pledging US$10 billion of assets to a unit under the city government. Three years earlier, R&F was the white knight for beleaguered fellow property magnate Wang Jianlin, when it emerged in the eleventh hour with a 19.9 billion yuan offer to take 77 hotels off Wang's hands.

R&F has 9 billion yuan of debt due in the second quarter, with another 3 billion yuan due in the second half. It reported 36 billion yuan of cash at the end of September 2020, including 30 billion yuan set aside for normal operations, according to Fitch Ratings.

Guangzhou R&F Property's then vice-chairman Zhang Li (left) during the company's listing ceremony at the Hong Kong stock exchange in Central on July 14, 2005. Photo: SCMP alt=Guangzhou R&F Property's then vice-chairman Zhang Li (left) during the company's listing ceremony at the Hong Kong stock exchange in Central on July 14, 2005. Photo: SCMP

R&F's chairman Zhang Li, who is a delegate to the economics section of the CPPCC, will need to improve the liquidity of his company, now classified red, said CreditSights' senior analyst of Asian high-yield companies Cheong Yin Chin in Singapore.

"It still has a lot of onshore bonds and the cash held by the company is tight," Cheong said. "The only good news is that many of its land parcels are in the Greater Bay Area, which are easier to sell. It just needs to sell more quickly."

China's central bank and financial regulators have already sounded the alarm, raised the red flag and put the most indebted developers on notice.

Lam Lung-on, chairman of the board of Yuzhou Properties, during an August 25, 2016 interview in Central. Lam is an NPC delegate representing Hong Kong. Photo: Bruce Yan alt=Lam Lung-on, chairman of the board of Yuzhou Properties, during an August 25, 2016 interview in Central. Lam is an NPC delegate representing Hong Kong. Photo: Bruce Yan

More than a third of China's outstanding loans have gone to the property sector, whether as financing for developers or mortgage for homebuyers, according to remarks in December by Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission (CBIRC), who likened China's property loans to a "grey rhino" risk.

And defaults like China Fortune Land's missed bond payment of 5.26 billion yuan in February still give regulators heartburn.

"Delegates running the big real estate companies will have to hand in some plans, but the government will never let the big ones default," said Cheong. "Think about how many people will be out of jobs. As long as the government sees the big ones on track in cutting their debts, they can get some leeway."

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2021 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2021. South China Morning Post Publishers Ltd. All rights reserved.

https://www.edgeprop.sg/property-news/real-estate-moguls-greece-size-debt-problem-look-hints-relief-even-chinas-legislature-tries-wean

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Search Articles