Office market deals pick up

By Cecilia Chow

/ The Edge Property |

The office market is now abuzz, as sentiment has swung from pessimism to optimism in just one year. Fears of an oversupply in the office market 18 months ago have evaporated, with investors now forecasting a period of relatively modest supply in 2018 to 2020. Jeremy Lake, CBRE executive director of capital markets, observes: “Singapore goes through periods of too much office space, and then periods of relative shortage.”

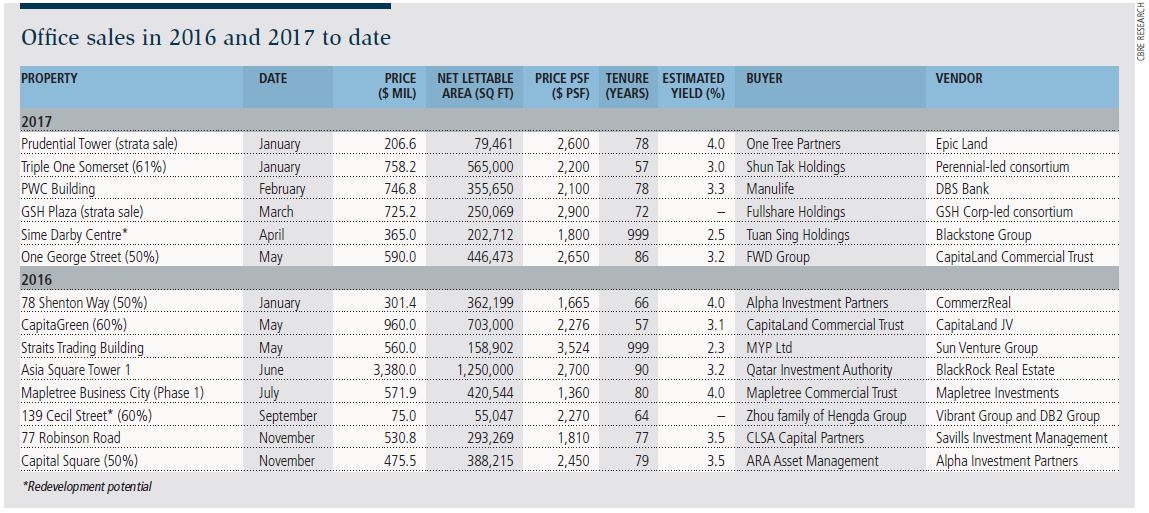

In the first four months of 2017, $3.39 billion worth of office deals were transacted. They include deals valued above $100 million, ranging from the sale of substantial strata space to stakes in a building or an entire building. The latest office deal done early this month was the sale of a 50% stake in Grade-A office building One George Street for $590 million ($2,650 psf). The buyer was FWD Group, the insurance arm of investment vehicle Pacific Century Group, controlled by Richard Li, the younger son of Hong Kong’s richest tycoon Li Ka-shing.

CBRE brokered four of the six office deals done so far this year, amounting to $1.91 billion, or 56% of the total $3.39 billion transacted. This includes the sale of the 50% stake in One George Street and DBS Bank’s entire interest in the holding company of PWC Building to an indirect subsidiary of Manulife Financial Corp for $746.8 million, considered one of the biggest office deals in 1Q2017.

Advertisement

In the first four months of 2017, $3.39 billion worth of office deals took place

The two other office deals brokered by CBRE this year were the sale of Sime Darby Centre to Tuan Sing Holdings for $365 million; and the sale of 79,500 sq ft of strata space in Prudential Tower to private-equity firm, One Tree Partners, for $206.6 million (see table).

The remaining two office deals that CBRE was not involved in were direct deals between the vendors and buyers. One was the sale of the entire interest in Plaza Ventures Pte Ltd — the registered owner and developer of GSH Plaza — to Fullshare Holdings for $725.2 million. The other direct deal was the sale of the 61% stake in Triple One Somerset to Hong Kong-listed Shun Tak Holdings for $758.2 million.

Tuan Sing Holdings recently purchased Sime Darby Centre, which has redevelopment potential

--thisisapagebreak

Investor confidence up

Today, investor confidence in Singapore’s office market is on the rise, says Greg Hyland, JLL Singapore’s head of capital markets. “They are acutely aware that the window of opportunity to acquire available assets at an attractive point in the cycle is fast closing. The office leasing market is already showing signs of stability at the prime CBD end.”

Things could not have been more different 18 months ago. At the start of 2016, there were fears of an impending oversupply arising from the completion of Guoco Tower at Tanjong Pagar Centre, Marina One office towers at the New Downtown and UIC Building at V on Shenton. Investors were unsure what the impact would be on rents.

Towards mid-2016, however, sentiment started to shift. The catalyst was the sale of Asia Square Tower 1 to Qatar Investment Authority for $3.38 billion in June, coupled with two deals in May: Straits Trading Building, which was sold to Indonesian tycoon Tahir’s MYP for $560 million; and the sale of a 60% stake in CapitaGreen to CapitaLand Commercial Trust for $960 million.

Leasing at the new office towers also picked up towards 2H2016. Today, Guoco Tower is 91% leased. UIC Building is about 50% taken up and DUO is about 45% leased. Meanwhile, more than one million sq ft has already been pre-leased at the Marina One office towers, which have about 1.8 million sq ft of premium office space.

Advertisement

Investors were emboldened by the leasing progress at these new office schemes as well as the pace of office transactions in 2H2016, says CBRE’s Lake. In fact, 2016 ended on a high note with two office deals in November: the sale of a 50% stake in Capital Square to ARA Asset Management for $475.5 million and the sale of 77 Robinson Road for $530.8 million to CLSA Capital Partners. Both deals were said to be brokered by CBRE.

“By January 2017, five out of 10 investors would consider buying an office space, and today, it’s more likely to be six in 10,” notes Lake. “Just a year ago in January 2016, only one in 10 would consider buying.”

In 1Q2017, the office sector was already the top performer in terms of investment deals, with $2.12 billion — or 47.5% — of a total of $4.99 billion in sales across all sectors of the real estate market, says JLL in a release on May 8. The 1Q2017 figure was also the highest 1Q performance in nine years for the office sector since the peak in 1Q2008, when $3.41 billion worth of office deals took place.

Office rents bottoming out

Therefore, some investors believe that rents today may have bottomed. According to Corporate Locations’ Singapore Market Review in March 2017, average top rental rates are now in the range of $8.50 to $9.50 psf per month. The rate of decline in the prime segment of the office market has slowed significantly and, in some cases, such as that of Guoco Tower, rates are even higher than they were six months ago. “Generally, we expect top prime rates to soften only marginally, by around 5% during the course of 2017, but they are beginning to bottom out,” says the office specialist.

It will be the mid-tier office market that will experience the greatest pressure over the next 12 months, with further falls in rents of around 10%, notes Corporate Locations. “There will be some huge voids appearing in some of the older established buildings, as a result of major relocation this year, and these buildings will be under the most pressure.”

Property consultants are projecting that office rents will recover next year. According to Corporate Locations, 2018 will be an important year for office relocations. “There will be a lull in new supply for a couple of years after that, with the next wave of supply not coming onstream until 2020/21.” (See table on office supply for 2017 to 2021.)

Advertisement

--thisisapagebreak

Wave of Hong Kong money

Another interesting trend is the wave of capital from Hong Kong into the office market. For instance, Macau casino king Stanley Ho’s Shun Tak Holdings raised its stake in Triple One Somerset; Pacific Century Group’s FWD acquired a stake in One George Street; and Hong Kong-listed Fullshare Holdings, which acquired the entity behind GSH Plaza, is the investment holding company controlled by mainland Chinese billionaire Ji Changqun.

“In all the time I’ve been working here, I’ve never seen as much interest from Hong Kong groups,” says Lake, who has been with CBRE since 1991. Lake reckons the wave of Hong Kong money into Singapore’s office market is due to the perception that it is coming out of a dip. “With prices and rents having softened, these Hong Kong groups feel it’s timely to relook at Singapore, as it presents good value,” he says.

Likewise, the wave of Chinese money into Singapore will also increase. “In many cases, the Hong Kong and Chinese groups have already invested in London, Australia or New York. So, the missing piece in the jigsaw puzzle is perhaps Singapore,” notes Lake.

The spectrum of buyers is also diverse. In addition to Chinese and Hong Kong money, there are also sovereign wealth funds. Abu Dhabi Investment Authority, for instance, is in a joint venture with Lendlease at Paya Lebar Quarter; Qatar Investment Authority now owns Asia Square Tower 1; and Norway’s US$935 billion ($1.3 trillion) sovereign wealth fund, the world’s largest, is also reportedly seeking suitable real estate projects in Singapore and Tokyo.

Redevelopment potential

Some companies are buying properties with the intention of redeveloping them. For example, the site that Sime Darby Centre occupies is zoned for commercial use. It is therefore likely to be redeveloped by Tuan Sing into a new commercial building with a mix of office and retail space. “A commercial development has higher value than residential,” says Lake.

A 100% interest in the 11-storey office building at 139 Cecil Street is on the market for sale. Built in the 1980s, the property occupies a 7,936 sq ft site and has a 99-year lease dating from August 1981. The building is vacant, as the vendor intends to redevelop it into a 16-storey boutique commercial building with office space on the upper floors, F&B outlets on the ground floor and carpark facilities. The new building will have a total lettable area of 85,000 sq ft, which includes a communal roof terrace and recreational facilities. It will be sold on a completed basis, with redevelopment scheduled for completion by 2Q2018.

The building is on the market by expression of interest, with a price tag of $210 million, and Cushman & Wakefield is the marketing agent. The price is equivalent to the amount paid by Shanghai Hengda Group, a Chinese real estate group headed by the Zhou family from Shanghai, for neighbouring building 137 Cecil Street in December 2015.

Hengda Group had purchased the 60% stake in 139 Cecil Street for $75 million last September. The remaining 40% stake in the building is held by a joint venture between Vibrant Group and DB2 Group. Shaun Poh, Cushman & Wakefield executive director of capital markets, says: “The reason for the sale [of 139 Cecil Street] is that the vendor was approached by several parties that made offers for the building. That prompted the expression of interest exercise.”

The building on Cecil Street is also attracting Chinese and Hong Kong companies looking for an office building in the CBD where they can have naming and signage rights.

--thisisapagebreak

Strata sales to return

The original intention of the vendors of 139 Cecil Street was to carve up the office building into strata units for sale. They have already obtained approval to strata-subdivide the new development at 139 Cecil Street into 99 office units and three retail units. Eighteen months ago, interest in the strata office market became muted when there were fears of a looming oversupply. “The subsequent owner has the option to sell the strata-titled units when the market returns in the future,” says Cushman & Wakefield’s Poh. “The strata sale market seems to be coming back, but the trend appears to be for bulk purchase.”

He reckons it is partly due to the diversion of some funds from the residential market when the opportunity for bulk purchase closed on March 11. That was when the government imposed a new rule in the form of additional conveyance duties for residential property transactions that involve acquiring a significant equity interest in entities that hold primarily residential properties.

A total of 79,500 sq ft in strata space at Prudential Tower was sold for $206.6 million in January, to be followed by another big strata sale of $150 million

This effectively plugged a loophole that allowed Singaporean investors to participate in the bulk purchase of unsold units in a residential development by buying the holding company and enjoy substantial savings in stamp duties, unlike those who purchased the residential units directly.

“But it’s not the sole reason for the shift in interest from residential to office deals,” says Poh. “There’s a lot more interest in office buildings, especially when there are very few office buildings in the CBD that are in the $100 million-to-$200 million price range.”

With the more positive outlook for the office market, interest and activity in the strata office space will also pick up, says CBRE’s Lake. In addition to the strata sale of the 79,500 sq ft of office space in January for $206.6 million, another strata sale of about $150 million is underway at Prudential Tower.

In February, an entire strata floor of more than 13,000 sq ft at Samsung Hub (adjacent to Prudential Tower) was sold for $43 million ($3,280 psf). The price of $3,280 psf is equivalent to the price achieved in the sale of the entire strata floor sale on the floor above, the 21st level, which was slightly smaller at 12,841 sq ft and sold in October 2014 for $42.1 million, according to a caveat lodged.

According to Lake, average office prices today are still 10% below the last peak in late 2007 and 1Q2008. “We expect more deals during the rest of the year and activity to continue.”

This article appeared in The Edge Property Pullout, Issue 779 (May 15, 2017) of The Edge Singapore.

https://www.edgeprop.sg/property-news/office-market-deals-pick

Tags: |

Follow Us

Follow our channels to receive property news updates 24/7 round the clock.

Subscribe to our newsletter

Advertisement

Advertisement

Advertisement

Top Articles

Search Articles